In brief:

- With EISA legislation approaching its second year in effect, the impact in the factory still seems limited.

- Permanent magnet (PM) motors are known to not only provide higher levels of efficiency than can be achieved by induction motors, but do so over a very wide speed and load range, where induction motor efficiency drops off dramatically.

- Manufacturers have released technologies that are above premium efficiency.

A perfect storm has been brewing around electric motors and drives. On Dec. 19, 2010, the Energy Independence and Security Act of 2007 (EISA) (Public Law 140-110) took effect. The law implemented new energy-efficiency standards for three-phase induction motors from 1 to 200 hp. In addition to the new law, significant increases in the cost of the rare earth elements used in permanent magnets have been anticipated as China’s use of the metals begins to exceed its production. Small-hp motors will be added to EISA in 2015, and the U.S. Department of Energy is looking at new efficiency updates for variable-speed motor-drive systems.

EISA impact

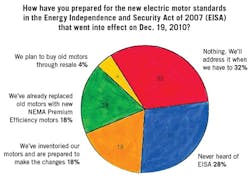

With EISA legislation approaching its second year in effect, the impact in the factory still seems limited. Only about 18% of plants have replaced any motors with EISA qualified units, according to the annual Plant Services survey on the use of motors and drives (Figure 1). However, EISA governs the sale of motors by producers, which could explain why customer involvement remains delayed.

Figure 1. EISA governs the sale of motors by manufacturers, which could explain why customer involvement remains delayed.

At the motor factories, the picture is somewhat different. As a result of EISA implementation, all integral-horsepower general-purpose electric motors manufactured after Dec. 19, 2010, are required to meet NEMA premium efficiency levels, says Scott Johnson, vice president of NovaTorque (www.novatorque.com). All OEMs are now accountable for the efficiency of motors in their equipment.

“To achieve these higher levels of efficiency, manufacturers of ac induction motors have moved to higher-grade electrical steel, additional copper, and cast aluminum rotors,” says Johnson. ”The improvement has been significant, and the additional cost associated with the manufacturing of these more efficient motors was economically justifiable by the reduced cost of energy.”

Some plants are even specifying premium efficiency motors for other motors not mandated to be premium, adds John Malinowski, senior product manager at Baldor (www.baldor.com).

Rare earth metals

“While further improvements in induction motors are possible, the design has reached the point of diminishing returns,” says Johnson. “The cost of further improvement will not yield sufficient additional energy savings to justify the additional investment. Plus, motor size for the same horsepower would likely have to increase, further complicating the adoption. The next step up on motor efficiency is therefore unlikely to be an induction motor.”

Figure 2. Some plants are even specifying premium efficiency motors for other motors not mandated to be premium, and many applications show acceptable paybacks today when improved system reliability is taken into account (Source: Baldor)

Permanent magnet (PM) motors are known to not only provide higher levels of efficiency than can be achieved by induction motors, but do so over a very wide speed and load range, where induction motor efficiency drops off dramatically, explains NovaTorque’s Johnson. “As many applications now incorporate speed control for efficiency or process improvement, this provides PM motors with a significant advantage. The issue, however, has been cost. PM motors, due to the use of expensive rare-earth-magnet material, have a first cost than can be double or more than that of an induction motor. Payback on that price premium can be prohibitively long.”

Some of the new technologies, such as permanent magnet rotor motors, are very good efficiency upgrades that will be more adopted as magnet prices fall, says Baldor’s Malinowski. “Even so, many applications show acceptable paybacks today when improved system reliability is taken into account,” he adds (Figure 2). “Many projects cannot be justified on energy savings but on eliminating downtime while also saving electricity. For example, it is difficult to take an operating motor out of service for an efficiency upgrade. Payback may be in the three-to-four-year range, well beyond the two-year payback most companies are seeking. When the motor fails, it will be replaced with an upgraded unit or replaced early before failure if a more robust motor is selected that will prevent downtime, while also saving electricity.”

Newer motor and drive technologies

Manufacturers have released technologies that are above premium efficiency, explains Malinowski. “These are not conventional AC squirrel cage induction motors, but motors with permanent magnet rotors, switched reluctance, synchronous reluctance, and other technologies, most requiring a drive for operation,” he says. “Drives are becoming more powerful and sophisticated at a more competitive price. New motor technologies are available that could be more power-dense — more horsepower in a smaller package — or much more efficient. Sophisticated users are adopting sustainable corporate policies based on using efficient technologies, not on lowest first cost.”

One trend is to adopt a systems approach, rather than individual component replacement, adds Malinowski. “A matched system can be more efficient when sized for the particular application parameters,” he explains. “The system would include all components inside the electric motor: power distribution transformer, smart starter/soft starter/drive, motor, mechanical power transmission components, highest efficiency in driven load, and process control to make it work in harmony with other activities in the plant.”

For some applications, the economic potential of drives is more exciting than that of motor developments, says Douglas Weber, business development manager, Rockwell Automation (www.rockwellautomation.com). “When you look at variable-speed motors and drives, in most applications the overall process efficiency that is gained by the application of a drive is so large that a gain in efficiency from 95% to 96% in the motor or drive itself is not really that significant,” he explains. “For drives, we've seen a continuous march of slowly increasing efficiency with each new generation. Those efficiency improvements are really driven by the desire to reduce the size, weight, and cost of drives, not directly by increasing efficiency. To reduce size, weight, and cost of a drive, you have to reduce the heat generated inside the drive, along with increasing your ability to remove heat from the drive. Reducing the heat means efficiency is also higher, but that is due to the focus on size, weight, and cost. There also may be a bigger effect going forward coming from the alternative energy space, especially the solar PV market, where the focus on efficiency is understandably much higher.”

Figure 3. Potential might exist for the expansion of variable-frequency drives into additional applications, where they aren’t yet applied. (Source: Rockwell Automation)

When you introduce variable speed to an application, you get such a huge benefit that an extra point of efficiency in the motor isn’t all that important, argues Weber. “It's been more of a focus for fixed speed motors,” he says. “However, we’ve seen an increase in interest over the last several years in efficiency, especially in the application of permanent-magnet motors to a broader range of applications. There also is a focus on innovation in new motor technologies by the motor manufacturers to gain additional efficiency. Another new area of focus would be fan efficiency.”

Weber sees potential for the expansion of variable-frequency drives into additional applications, especially retrofits, where they aren’t yet applied (Figure 3). “The biggest opportunity is in using more drives,” he offers. “Beyond that, equipment builders are increasingly looking to use machine efficiency as a marketing point for the equipment they sell. This is much more common today than it was even five years ago, and it’s driving the adoption of energy-efficient motor technology and drives into equipment.”

Integrated drive systems, including drives, motors, gearboxes and couplings from a single source supplier will be a trend for process control and energy savings, explains John Caroff, marketing manager, low voltage motors, at Siemens Industry (www.industry.usa.siemens.com). “Offerings like this help end users reduce project development, engineering and commissioning timeframes by having a single point of contact for an entire drive system,” he says.

Eliminating mechanical losses

William B. Gilbert, application engineer at Siemens Energy and Automation (www.industry.usa.siemens.com) says significant energy is lost through friction and mechanical inefficiency in two ways with converting machinery. The first is mechanical drive systems or gear boxes with high ratios. The second is unwinds having mechanical tension control brakes.

Eliminate gearboxes having direct-drive torque motors. High gear ratios are required when sizing motors that drive large-diameter rolls or on very low speed web applications. Where planetary gearboxes are fairly efficient, high-ratio multi-stage worm gear boxes easily can have efficiencies below 60%. Low-speed applications and driven sections that use inefficient gearboxes are becoming direct-driven with torque motors and even conventional motors, thus eliminating the energy losses. Typical applications on converting lines using torque motors with direct drive are chill rolls, large-diameter casting rolls, and operations requiring very low speed web control.Unwinds with mechanical brakes are ideal items from which to recover energy. Mechanical brakes use friction to supply web tension. The heat produced in the process is, in effect, energy that can be recovered. Pneumatic or electromechanical tension control brakes are being replaced with an AC drive system having line regenerative capability.

A driven unwind must return the tension energy back to the AC line. In the past, regenerative DC drives have been applied in these applications successfully, but DC drive systems are no longer common. Even during their prime, they were very costly when compared to their mechanical counterparts. Early on in AC drive technology, the drives couldn’t regenerate power back to the AC line. When applied as unwind brakes, they required regenerative resistors to dissipate the tension energy. This was wasteful and costly.AC drive systems now regenerate energy back to the AC line just as the DC drive did, but with added benefits to the user and machine designer alike. Sending the tension energy back to the line means power that once was wasted can be retained, instead of the system producing heat and worn parts. Additionally if the drive is equipped with active front-end technology, it returns the energy with near unity power factor, something not possible for any DC drive system.