State of the workforce: Get a full picture of the evolving industrial labor force

[javascriptSnippet]

One of the truisms in industry is that the modern plant workforce is undergoing deep and rapid change. The generational change may be the most notable, as some plants report that the majority of plant workers only five years ago were Baby Boomers; now, Millennials comprise the largest percentage, with a stable number of Generation X workers positioned firmly in the middle.

As Managing Editor Christine LaFave Grace noted in her October cover story on the changing plant workforce, the full picture of the evolving industrial production labor force has to do with more than age: "It’s about women and members of immigrant communities pursuing shop-floor jobs; ... it’s about midcareer maintenance employees finding themselves rebranded as reliability experts; ... and it’s about plant owners and managers having to rethink how and when they schedule shift work" to offer employees greater work-life balance.

Leah Friberg, global education, content development, and public affairs manager at Fluke, sees these issues as also spanning a much broader market sector than manufacturing. "Companies that depend on margin now look at all aspects of operations for inefficiencies, trying to reduce overhead and protect that bottom line," says Friberg. "Managers are put in the hot seat of increasing productivity using existing resources while trying not to jeopardize employee satisfaction. There’s a point of diminishing returns where everyone is moving so quickly on so many tasks that the chain falls off and we are simply pedaling without moving forward."

As part of our 2015 coverage on this topic, Plant Services conducted a survey of manufacturing and industrial production professionals this fall, asking readers for their thoughts on a comprehensive set of workforce-related topics, from the effects of automation and smart connected machines on their facility's labor force to the qualities they look for in an employer. This article presents key trends and findings from that survey, sketching out a collective portrait of the actions and attitudes shaping our industry's response to deep waves of social, technological, and demographic change.

Background

To get a better understanding of our readers, we asked survey responders some baseline questions. The vast majority of respondents fit into one of two generational categories: Boomers (60%, born 1945-1964) or Generation X (31%, born 1965-1980). Despite data from the Pew Research Center indicating that Millennials surpassed Gen Xers in the first quarter of 2015 to become the largest segment of the U.S. labor force, only 7% of respondents identified as being from the Millennial generation (born 1981-2000). Also, although research from the national trade group Women in Manufacturing indicates that women make up about 47% of the workforce in the United States, and comprise 27% of personnel in manufacturing, only 7% of survey respondents to date are women.

The job function breakdown for respondents was as follows: Engineers (22%) and maintenance/reliability specialists (19%) had the largest representation; plant managers (11%), department heads (9%), managers (14%), and supervisors (11%) followed, with operators (3%) at the low end and a combination of EHS, process control, quality assurance, work planning, and technical support specialists comprising the rest.

Respondents were also nearly evenly split when indicating whether their plant's location was urban (29%), rural (30%), or suburban (41%). When asked if they thought location had an impact on their organization's ability to retain talent, half of respondents thought it had no effect, while a majority of the rest (32%) thought it had a negative effect.

Skills and technology

One set of questions focused on the degree to which respondents thought that their facility was open to embracing new and/or disruptive technologies. When it comes to implementing reliability programs, most organizations are well down that road: 90% of respondents said they either have implemented a reliability program or have plans to do so. Respondents also agreed that reliability programs were a positive influence in keeping both newer and older workers engaged.

Opinion started to diverge in the areas of mobility/machine interfaces. Most respondents (72%) indicated that they were keeping up with machine interface advancements, but only 20% thought innovation in this area was crucial to keep older workers engaged. When it comes to mobile technology adoption, 73% said that their company encourages the use of mobile devices to get work done, and 93% reported feeling comfortable using mobile devices on job-related tasks.

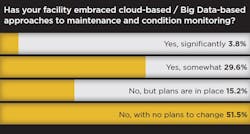

Perhaps the biggest surprise was in the area of cloud-based Big Data approaches to maintenance and condition monitoring: 52% of respondents indicated that their organization had not embraced these technologies and had no plans to do so, despite the same share of respondents admitting that they thought these technologies could make a difference in keeping newer workers engaged.

Burt Hurlock, CEO of Azima DLI sees the data as telling a tale of two cultures. "There is a group of organizations out there that are clearly leaning in and understanding that they need to invest in human capital. There's online training, there's support, there's mentoring, all kinds of things you would do if you were taking your human capital seriously. There's an almost equal number of companies out there, assuming that the data reflects a natural, level distribution, that are doing absolutely nothing about it."

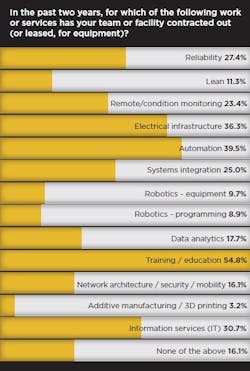

Data from across the survey collectively support this impression. When asked which type of service for which teams or facilities had contracted out in the past two years, 55% of respondents checked "training/education." (This was by far the most commonly contracted service.) When it comes to training and development programs, 62% indicated that skills training was available to them and 58% indicated that leadership training was available; however, only 23% reported that a formal mentoring or coaching program was in place.

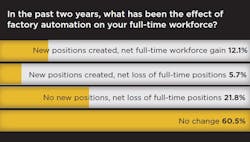

Interestingly, responses to questions about how two particularly disruptive trends/events affected employers–the sharp increase in factory automation and the 2008 recession–helped give weight to the general impression of a brain drain from inside the four plant walls to places outside. A surprising 61% reported that factory automation trends have not had any effect on plant staffing, although 22% reported a net loss of full-time positions due to automated work processes, and 38% said they are concerned about job security.

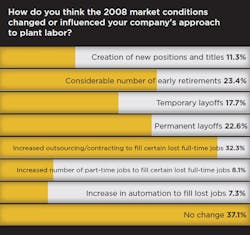

The data shifted a bit regarding the 2008 market, where 41% of respondents reported either temporary or permanent layoffs having taken place as a consequence, and 32% also reporting an increase in outsourcing and contracting to fill certain lost full-time positions. "There are some noncore specialties that the plant can't or doesn't want to keep up with, and those specialties are being outsourced," says Hurlock.

Recruitment and retention

Hurlock sees a connection between these trends and the 57% of respondents who cited "better opportunities elsewhere" as a primary motivator for moving from one job to another.

"The Internet, rightly or wrongly, is concentrating expertise," he says. "Because the Internet can concentrate information and deliver it to experts, it is actually accelerating the expertise of the experts, and by definition this means that it is leaving behind the generalists. In the survey data, you can see that what is being outsourced tends to be specialties that aren't core specialties, and you can see the companies that are doing it–they are the ones who are leaning forward and trying to solve the brain drain problem. You can also see the companies that aren't doing it, and the best employees are moving from one to the other."

Respondents clearly indicated that the reasons for employee departures are related much more to compensation, opportunity, and work/life balance than they are to any particular flavor of downsizing (automation, offshoring, outsourcing, and budget reduction). More than two in five respondents (43%) see themselves departing their organization within the next five years.

"Hertzberg’s Motivator-Hygiene Theory states that a person’s hygiene needs need to be reasonably well-satisfied before motivational techniques can be fully effective," says Tom Moriarty, CMRP and president of Alidade MER. "People are making their decisions to stay or go based on basic need factors. The sluggish economy and stagnant wage growth makes people restless. If you want to keep people around for more than five years, then ensure you’re providing compensation at or above prevailing rates, be attentive to work-life balance, and make sure your supervisors and managers have good or excellent leadership skills."

Respondents also cited burnout and overwork as a significant area of concern. When asked if their current responsibilities included additional locations beyond their primary facility, 40% said yes, and 45% reported feeling burnout on the job. When asked if they often work beyond their scheduled number of hours, 64% said yes. Finally, when asked if they commonly work on tasks outside their job description or otherwise multitask on the job, a whopping 82% said yes.

"That was another interesting piece of the data," says Hurlock. "Respondents say they continue to be overworked and stretched beyond their expertise, which to me means that their expertise is starting to be diluted by the demands that the organization is placing on them, which only accelerates the concentration of expertise to third parties."

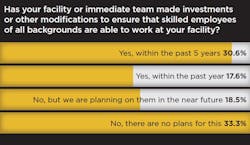

On a more positive note, a clear majority of respondents said that management values new ideas and employee input (72%), and the same share indicated that their company offers opportunities for employees to volunteer for charitable causes or events. Also, an overwhelming majority said that their company values diversity (85%). On the specific impact of immigrant communities on workforce tactics and attitudes, 45% indicated that they perceived an opportunity to increase hires from these communities and/or create a more diverse workforce, and nearly the same share indicated that they would make additional investments in training (43%) as a result of these new hires. (Investments in plant safety were a moderately close second, at 31%, with an emphasis on safety signage, equipment, and training.)

These data can be considered positive in terms of recruiting, which according to the survey is another challenge area for many organizations. When asked to rate the performance of their company's current recruitment program, 64% gave their program a thumbs-down as either ineffective or needing improvement. Perhaps reflecting this challenge, the data also indicate that a majority of organizations are partnering now or will be in 2016 with a university, college, and/or industry group to identify new talent.

"It is great to see in the survey results that close to 50% of the respondents are actively partnering with universities, colleges, and industry groups like ours to cultivate talent," remarks Allison Grealis, president of Women in Manufacturing and a vice president of the Precision Metalforming Association. "With 600,000-plus open manufacturing positions, companies need to be proactive in forging relationships that will fill their pipeline of candidates and support the professional development needs of their talent."

Challenges going forward

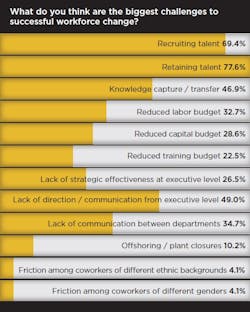

One of the survey's final questions asked what respondents thought were the biggest challenges to successful workforce change. The available options differed based on whether the respondent occupied a management-level role.

The top challenges cited at the manager level were talent retention (78%) and talent recruitment (69%), with knowledge capture and reduced labor, capital, and training budgets running distantly behind. On the engineer/practitioner side, the top challenges cited were overwork because of a lack of skilled workers (75%), knowledge capture/transfer (58%), and lack of access to training and career development (49%).

Reviewing these data, Friberg comments: "The survey calls out lack of communication between departments or from executives as a bigger issue than lack of hiring budget. Knowledge capture issues were second only to lack of skilled workers. People’s ability to get work done depends every bit as much on the systems and soft skills they have as the number and skill level of the people on the floor."

Tony Espinosa, vice president of human resources and administration at Des-Case, has witnessed a phenomenon with top talent: a robust life outside of work. "Clearly, work-life balance is important to most people, but both sides of the scale contribute to how it measures up in one’s life," he says. "Perhaps high-level engagement across life, in and outside of work, is simply characteristic of top performers. If true, leadership must remain cognizant of any ‘seasons of unbalance’ in order to best lead strong employees."

The survey data ultimately present a fairly stark choice to employers. "The fact that a market has industry leaders and followers is as old as markets themselves, and there are good reasons to do both – there are good reasons to lead, and there are good reasons to follow," says Hurlock. "The question is, how much are the followers leaving on the table for the leaders to establish permanent competitive advantage by not reacting? Is the loss of talent something from which they can really recover in this environment?"

About the Author

Thomas Wilk

editor in chief

Thomas Wilk joined Plant Services as editor in chief in 2014. Previously, Wilk was content strategist / mobile media manager at Panduit. Prior to Panduit, Tom was lead editor for Battelle Memorial Institute's Environmental Restoration team, and taught business and technical writing at Ohio State University for eight years. Tom holds a BA from the University of Illinois and an MA from Ohio State University