Maintenance Mindset: Inflation-driven trends are causing unplanned downtime costs to surge 300% in heavy industry

Welcome to Maintenance Mindset, our editors’ takes on things going on in the worlds of manufacturing and asset management that deserve some extra attention. This will appear regularly in the Member’s Only section of the site.

A series of tough reports have been released this past week, touching on new job creation and consumer spending sentiment.

Last Friday the U.S. Bureau of Labor Statistics revised job gains in May and June sharply downward by 258,00, with only 73,000 jobs added to the economy in July. Inflation also picked up again in July and is up to 2.9%, which is above the Fed’s 2% target, and almost 90% of adults in the U.S. say they are stressed about grocery prices.

But inflation is not only impacting the price of eggs.

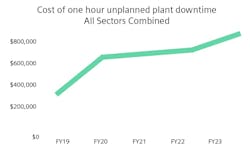

This past week I came across a fascinating research report published by Siemens in 2024, that tracks how the cost of unplanned downtime in U.S. industry has risen over the past five years. The report’s lead finding is that a spike in the cost of downtime in key industrial sectors has dramatically outpaced inflation over the past five years. From the report:

- U.S. price inflation has totaled 19% over the five years studied (2019-23)

- The cost of an hour’s downtime has risen by 113% in the Automotive sector ($2.3 million / hour).

- The cost of an hour’s downtime has risen by 319% in Heavy Industry

One last piece of bad news from the report: the researchers found that the global post-COVID energy crisis are largely responsible for rising downtime costs. Since the summer of 2021, “global energy prices rose sharply as economies came out of COVID lockdown. Reduced output from some energy producers led to further increases, as did the invasion of Ukraine in early 2022, which brought global uncertainty about energy supply and further price rises. Costs spiked in 2022, with oil prices almost three times higher than 2019.”

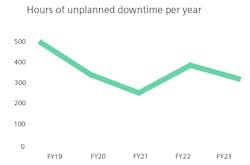

However, there also is some very good news in the report for those in industry who have been fighting unplanned downtime with every tool at their disposal: average hourly plant downtime across all sectors is down by nearly a third since 2019!

I had to read that number twice. You might have to read it twice too. Specifically, the researchers found that, since 2019:

- Major manufacturers suffer 25 downtime incidents a month per facility on average, down from 42

- They lose 27 hours per plant per month, down from 39

- In Automotive and Heavy Industry, hours lost to unplanned downtime have halved over the past five years

- Of the sectors measured by the report, only the Fast Moving Consumer Goods sector has seen downtime hours increase

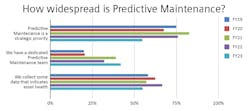

Ironically, the report found that fewer companies are citing predictive maintenance as a strategic priority – because PdM has become business as usual in maintaining asset health and fighting unplanned downtime. In fact the report finds that “nine out of 10 manufacturers we surveyed collect at least some data that gives them a view of machine health.”

I encourage you to take a look at the report for yourself, for the morale boost as much as anything. Our industry has been relentless in applying PM and PdM best practices whenever and wherever possible, and those best practices are helping organizations offset significant cost pressure from inflation. Remember that the next time someone says that the M&R function is more of a cost center than a profit driver.

About the Author

Thomas Wilk

editor in chief

Thomas Wilk joined Plant Services as editor in chief in 2014. Previously, Wilk was content strategist / mobile media manager at Panduit. Prior to Panduit, Tom was lead editor for Battelle Memorial Institute's Environmental Restoration team, and taught business and technical writing at Ohio State University for eight years. Tom holds a BA from the University of Illinois and an MA from Ohio State University