Pressures from the real world are driving computerized maintenance management/ enterprise asset management (CMMS/EAM) software vendors to rethink and revise not only their products, but how they can help users actually achieve a larger portion of the potential they shrink-wrap in every package. And theyre not doing it out of largesse the maintenance and asset management business landscape has been through several rough years of low or negative profits, consolidations and increasing competition.

More than ever, CMMS/EAM vendors need you, their clients, to succeed. Many have identified room for improvement and are focusing their efforts on four key areas: industry specialization, implementation, integration and functionality. The changes they wrought have prompted us to revise and expand the Plant Services CMMS/EAM Software Review, our detailed hands-on comparison of current offerings.

Table 1: Characteristics quantified at www.plantservices.com/cmms_review

- Vendor company size

- Industry specialization

- Package price

- Implementation

- Integration

- Multi-site support

- Global attributes

- Security & data integrity

- User interface

- Look-ups & searches

- Data entry

- Help features

- Workflow & business logic

- Analysis & reporting

- Work order control

- Preventive & condition-based maintenance

- Safety

- Priorities

- Planning & scheduling

- Inventory control & purchasing

- Budgeting & cost reporting

- Equipment history

- Mobile technology

- HR management

- Fleet maintenance

- Infrastructure maintenance

- Service & technology asset management

- Calibration

- Engineering design to maintenance

- Other specialized modules

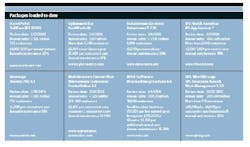

The 2006 Review is far too comprehensive to fit on the pages of the magazine it resides on a redesigned Web site at www.plantservices.com/cmms_review. There, you can find detailed information in the form of verified answers to a questionnaire covering 30 areas of vendor profile and package capabilities (Table 1). At press time, data from eight vendors is available (Table 2). More will be added as they launch new versions and choose to participate.

Click to enlarge Table 2

Heres my perspective after interviewing the participating vendors and personally testing their offerings.

Key differentiators

There are at least five ways to differentiate CMMS/EAM vendors, their products and services, and the markets that they serve. First, there are best-of-breed vendors that specialize in CMMS/EAM versus integrated solution providers, for which CMMS/EAM is one of many modules. Other modules within the integrated solution can include enterprise resource planning (ERP), customer relationship management (CRM), supply chain management (SCM), product lifecycle management (PLM), human-machine interface (HMI), and/or shop-floor data collection. Best-of-breed CMMS/EAM companies must build the appropriate interfaces with integrated-solution products to compete effectively, especially for large corporate accounts. The battle for market share between these two groups is quite fierce.

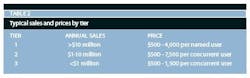

The second key differentiator is the size of client they typically pursue. Tier 1 vendors can accommodate the large, complex, global enterprise implementations with a price tag of more than $1 million. This is not to say that these providers cannot, and do not, handle smaller deals. However, if possible, they would prefer to focus on the large corporate clientele. At the other end of the scale, Tier 3 vendors typically handle smaller accounts in their local area, with minimal marketing. Tier 2 vendors are somewhere in the middle of these two extremes, with somewhat of a national or international presence, medium to large companies as typical customers, and fairly flexible pricing.

A third means of comparing providers is their areas of specialization. These, in turn, can be subdivided by industry (eg, nuclear versus municipality), product or service (eg, reliability-centered maintenance), type of maintenance (eg, fleet versus facilities) and specific features and functions offered (eg, calibration). The perception of the customer base is that no vendor can do it all equally well, although many have tried. It appears that specialization is on the rise as the market matures and competition increases.

The fourth means of differentiation relates to technology employed. This includes architecture (eg, Web-based versus client/server), database (eg, MS Access versus Oracle), operating system (eg, Windows versus UNIX), network (eg, standalone versus LAN/WAN based), and hosting (eg, internal versus externally hosted or ASP). In some cases, vendors have rewritten their software several times to take advantage of improvements in software tools and technology as they become available. Others have held on to legacy systems and built new user interfaces or back ends onto their packages to avoid expensive rewrites. Although customers can save money with the latter approach, the tradeoff might be reduced functionality, especially in the longer term.

The fifth and final area of differentiation is, of course, the myriad of features and functions offered. Some of these relate directly to the first four differentiators, such as functionality relevant to a given industry. However, many other features strongly distinguish one package from another, such as the ease of navigating around the system or the standard reporting and analysis tools offered with the package.

Trends: vendor capability and approach

The first five categories of the Review provide further clues on how to differentiate the vendors, including some insight into each ones strategy, market penetration and implementation approach. Trends in each of these sections are described below.

Vendor company size: One obvious differentiator for any company is annual sales revenue. In our survey, each vendor provided an estimate of annual sales revenue from the CMMS/EAM business. Table 3 shows annual sales and pricing for the three tiers referred above.

Note that each tier can be further subdivided into integrated-solution and best-of-breed vendors. Although the integrated-solution vendors can be substantially bigger, when you estimate sales revenue from their CMMS/EAM business alone, they are closer in line with their best-of-breed counterparts. However, stripping out CMMS/EAM sales only is no easy task when global deals are made bundling 20-plus modules and a host of services.

Another perspective on company size and, to some extent, market share, is the number of customer companies. The Review asks specifically for the number of companies as opposed to sites, as this provides a better indication of market penetration. On the other hand, although some vendors have sold CMMS/EAM packages to fewer companies, their customers are much bigger, which translates into greater annual sales revenue. Thus, a combination of the two measures, sales revenue and number of customers, provides the greatest insight into the nature and extent of relative market penetration.

During the past few years, there have been fewer entrants into the CMMS/EAM vendor world, along with tremendous consolidation. Many of the companies acquiring CMMS/EAM vendors are looking to expand their product and service offerings, such as large ERP, plant automation and specialty software companies. These are signs of a maturing market. From the customers perspective, this can be good news if product and service offerings are improved and better differentiated. Additionally, the companies that survive a period of consolidation tend to be more financially stable. However, with fewer competitors and more differentiated product and service offerings, there may be reduced pressure on vendors to negotiate prices.

Industry specialization: In response to growing demand for industry-specific features, providers have responded by:

- Building the features into their base functionality.

- Bundling industry-specific features with base functionality for each target industry, thus producing multiple industry-specific versions.

- Targeting one or a few industries with deeper specialization of products and services.

Some vendors prefer to stay general and avoid declaring an industry specialty, although they realize it is difficult to maintain a jack-of-all-trades image over the long term. And when you break down sales by industry, there is seldom an even distribution.

Other vendors are content to pursue a limited number of industries. The Review shows each vendors top five industries served.

Although each company or industry has unique needs and priorities, many features and functions are transferable to other industries, albeit perhaps with a different priority. For example, property management companies may place high importance on finding a CMMS/EAM that handles chargebacks to tenants in a fairly sophisticated way. Perhaps less of a priority, this functionality would also be useful for hospitals, hotels and airports that have a few retail tenants for which they provide maintenance services. Manufacturers that provide on-site maintenance services for the products they sell may also be interested in chargeback capability.

It appears that the greatest level of specialization is in addressing the needs of the asset-intensive, high-growth or niche industries. Examples are nuclear power, utilities, pharmaceutical, municipalities and third-party maintenance service providers.

Package price: Software pricing is one of the more complex aspects. As shown in Table 1, there seems to be a correlation between base package price quotes and tier level. Not surprisingly, Tier 1 quotes higher prices than Tier 2, who quote higher than Tier 3. However, many will negotiate prices lower than the list price ranges shown in the Review, depending on the number of users, future business potential, competitive pressures, backlog of committed customers and strategic value of the business.

Thus, its difficult to compare prices, even from vendors of different tiers, and the industry trend is toward increasing complexity. As well, there are many other complicating factors:

- Different pricing schemes such as price per named user versus price per concurrent user.

- Site license alternatives.

- Multiple modules and optional core software over and above the base price.

- Third-party software you buy outright or for which you pay licensing fees to the CMMS/EAM vendor (eg, data warehouse, report generator, workflow engine, graphics parts book).

- Prerequisite software or hardware (eg, operating system or database tools).

- Integration software and services to build interfaces with other applications.

- Peripheral devices and software such as barcode readers and label printers, RFID devices and scanners, and mobile technology.

- Hosting, rental or ASP options.

- Hidden, bundled or separately requested services such as data conversion, customization, training, implementation, installation, business process re-engineering, consulting and maintenance.

The only way to take all these factors into account and compare providers on a somewhat level playing field is to develop user requirements and issue a request for proposal (RFP). But you may not know the bottom-line differences in pricing until after you have reviewed the proposals and completed negotiations with each vendor.

Implementation: Even after multiple decades of experience with CMMS/EAMpackages, in my view, there is still a probability of less than 50% that the implementation will be a success. This view seems to be shared by others in the industry, and is similar to success rates quoted for implementing other software applications such as ERP, CRM and SCM. This is rarely because of selecting the wrong software package. The list of things that can go wrong is long, but the key reasons can be found in Table 4.

Table 4: Why implementations fail

- Poor top management support

- Inadequate user involvement and training

- Limited input from stakeholders

- Insufficient or inexperienced resources available for the project

- Inability to define and measure success for the project in terms of performance targets

- Weak planning (eg, unrealistic timetable)

- Lack of communication

- Deficient change management

- Not understanding organizational impact (changing roles and responsibilities)

- Poor understanding of how processes must change and how the CMMS/EAM must support those changes

- Unclear incentives for success, as well as unstated consequences for failure

A very slow trend in the industry is realizing that these factors wont go away with improved technology, as they are all related to human behavior. Its unfair to put much of the blame on the vendor, as they have every reason to make each implementation a roaring success theyre trying to build a list of successful references, and want long-term cash flow from happy customers, including revenue from maintenance fees, upgrades, additional products and services, and so on.

Therefore, much of the onus is on you, the end user, to beat the odds, and partner with the vendor to avoid the barriers to a successful implementation. Their answers to Review questions provide useful insight as to which vendors are experienced in, or at least willing to entertain, some innovative approaches to implementation. For example, would you be willing to set achievable performance targets and share savings with the vendor when targets are exceeded? Are you willing to provide a financial incentive to employees who are instrumental in exceeding those targets? If you answer yes, you will be contributing to this emerging trend.

Integration: More companies are discovering the importance of integrating the many applications scattered throughout their organization. The benefits can be enormous including improved productivity, greater response time, reduced number of errors, and, ultimately, better decision-making. Most companies have recognized this, and there appears to be an increasing demand for more integrated applications.

Some companies, especially the larger multinational ones, prefer integrated-solution vendors that provide seamless solutions across many modules. That is why such vendors continue to expand their offerings, adding applications through acquisition of companies or building new modules. Customers of the integrated-solution vendor are aware that not every module may be as feature-rich as they could get from the best-of-breed vendor, but the benefit of tight integration is perceived as more valuable than the loss in functionality.

The best-of-breed vendors are improving their ability to integrate with a host of popular applications, as shown by the Review. By building partnerships with as many vendors as possible and supplying software that makes it easier to quickly build an interface, best-of-breed vendors can compete more effectively with integrated-solution vendors. As the integrated-solution vendors improve their CMMS/EAM modules, the best-of-breed vendors look to the other means of differentiation described above.

Trends: general functionality

Categories 6 to 14 (Table 1) compare packages in terms of general features and functions. Of growing importance is how well they can support the variety of needs of small to large companies scattered around the globe (for example, supporting multiple languages and currencies) and consolidation across multiple business units, plants or warehouses. Another key trend is an ever-improving user interface such as better navigation aids that allow users to more quickly enter, analyze and report on data. Over the years, help features have dramatically improved with the advent of wizards, electronic cheat sheets and more interactive online help.

Expanded workflow and business logic capabilities are helping companies with such features as approvals, condition alarming, notifications and a host of other developments. But some of the most visible general improvements in the eyes of the users are the reporting and analysis tools, such as dashboards, user-definable KPIs and other features, under the business intelligence umbrella. Users at any level in the corporation can see potential problem areas at a glance, such as excessive downtime, then drill down to determine why there are variances.

Trends: asset management capabilities

Most users in the maintenance area will, of course, focus on the features and functions that relate directly to asset management. These are included in categories 15 to 30 of the Review. These sections carry data that clearly differentiates offerings in terms of meeting the needs of your asset management function. Many of the maintenance-specific features and functions will be discussed in greater detail over the coming months in my regular Asset Manager column.

How Berger gets the works

The detailed information presented at www.plantservices.com/cmms_review is the result of a 181-question survey probing in detail some 450 aspects of vendor companies and their packages, covering 30 categories (Table 1). Vendors that complete the survey are required to demonstrate their performance for every question under the watchful eyes of Contributing Editor David Berger, P.Eng. When vendors self-evaluations dont align with Bergers criteria, he corrects the survey responses accordingly.

The six-hour, in-person reviews guarantee consistent interpretation of each survey question and ensure that the same criteria are applied to every vendor. Berger examines responses that cannot not be audited (number of sites, pricing, annual sales, etc.) for reasonability in the context of his considerable experience.

Participating vendors pay a fee of $4,000 (plus travel and related expenses, where applicable) to partially defray the costs of performing and Web-hosting the Plant Services Review. One of our most experienced contributing editors, Berger is a Certified Management Consultant (CMC) registered in Ontario; a principal of Western Management Consultants, Toronto; and an adjunct professor at York University in Toronto, where he has taught operations management for the MBA program for 16 years.

From 1994 to 1998, he was vice president, projects and process engineering, operations and technology at banking conglomerate CIBC, responsible for the fundamental design and redesign of business processes and information technology. Before that, he held several positions in industry with Maple Leaf Foods (formerly Canada Packers Inc.) and Ferranti-Packard Electronics Ltd.

Berger has conducted numerous maintenance audits; helped senior managements develop maintenance strategies involving maintenance, operations, and engineering; assisted companies in implementing process improvement initiatives with significant results; and led a variety of IT projects, from developing a detailed specification to package selection and implementation, for CMMS/EAM, PdM, RCM and supply chain software. He was recently awarded the Sergio Guy Memorial Award in recognition of his significant contribution to the maintenance and asset management profession.

You can use the data in our CMMS/EAM Software Review with confidence to help refine your requirements, find packages that best fulfill them and compare them feature-to-feature with assurance that they were judged and are represented fairly and consistently.

Paul Studebaker, CMRP, Editor in Chief

About the Author

David Berger

P.Eng. (AB), MBA, president of The Lamus Group Inc.

David Berger, P.Eng. (AB), MBA, is president of The Lamus Group Inc., a consulting firm that provides advice and training to extract maximum performance, quality and value from your physical assets, processes, information systems and organizational design. Based in Toronto, Berger has held senior positions in industry, including for two large manufacturers, and senior roles in consulting. He has written more than 450 articles on a variety of topics such as asset management, operations management, information technology, e-commerce, organizational design, and strategy. Contact him at [email protected].