Economic pressures make it imperative to maximize asset reliability at the optimum cost. Life-cycle costing begins with the design and selection of new or replacement assets. Procurement takes place only after the initial stages (asset strategy, plan, evaluate and design) are completed. This is followed by the cost of operating, maintaining and sometimes modifying the asset before its eventual disposal (Figure 1).

Figure 1. These are the stages of an asset’s life cycle.

To complete the evaluation, however, you’ll need to factor in the asset reliability component, or what can be lost if equipment is less than reliable from the production perspective.

Many use a financial strategy of acquiring assets at the lowest initial cost, often termed “least first cost.” Considering an asset’s overall life-cycle cost instead of focusing on the least first cost offers the potential to acquire a more reliable asset even though initial cost is higher. What counts is the total cost of ownership, the sunken costs of development and the initial purchase price, as well as the operations and maintenance, modifications and eventual disposal costs. Note that the cost of lost production also is a significant cost of ownership. This new target can then decrease the total cost of ownership, especially when the production reliability value is considered.

Life cycle costing (LCC) is the conscious use of engineering process technology to increase system performance and reduce costs as far as possible, while satisfying, and often exceeding, customer requirements. LCC requires designing both the product and the product delivery process (i.e., the asset’s constructability and maintainability) for simplicity. This definition leads to two ways of viewing equipment acquisition:

- What are the costs related to owning the piece of equipment during its operating life, including disposal costs?

- What is the optimum combination of low initial costs and low running costs?

For the first alternative, a pigment manufacturer discovered that disposal cost for worn piping was increasing rapidly because of the naturally-occurring radioisotopes in the ore. Life-cycle cost analysis would have shown that changing the original piping design – although more expensive – would have saved disposal cost and more.

Consider the second alternative. A pesticide manufacturer performed a life cycle analysis of a new production pump that was considered, based on initial cost, to be too expensive. During the expected operating life of 15 years, the “cheaper” pump was expected to require two replacements. That fact alone justified buying the more expensive production pump.

Life-cycle cost design strategies

Figure 2. This represents more detailed life-cycle cost considerations.

The three predominate life-cycle cost design strategies are the minimum initial cost (IC) design, the minimum running cost (RC) design and the combination IC/RC reduction design (optimum cost). Regardless of strategy chosen, all acquisition and sustaining costs must be considered (Figure 2).

Figure 3. This is a schematic representation of what the initial-cost approach is trying to achieve.

The goal of the IC design is to minimize the asset’s initial cost without raising running or operational costs (Figure 3). The positive aspect of the initial cost design is that it provides the lowest initial cost from a technically capable bid. Companies using this cost design strategy are lucky if they get only what they pay for and not a host of operations, maintenance and reliability problems.

Figure 4. This is a schematic representation of what the running-cost approach is trying to achiev

The minimum RC design attempts to minimize running and operational costs as well as the costs of unreliability without raising the initial costs (Figure 4). Unfortunately, the lowest running costs might disguise and specify the gold-plated asset when the tin-plated version would meet the mission needs. Further, estimates of running costs are notoriously unreliable when estimating the life cycle of the assets. Even if the asset life is extended, the cost of running repairs is likely to increase.

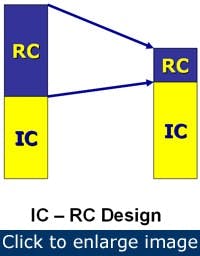

{pb}Figure 5. This is a schematic representation of what the combined approach is trying to achieve.

Not surprisingly, the optimum life cycle cost design is IC/RC reduction design. This design focuses on optimizing the balance between lower first costs and desired lower running costs (Figure 5). By doing so, manufacturers optimize their total cost of ownership.

Achieving optimized cost of ownership requires tradeoffs between acquisition costs and sustaining costs. Low initial cost could mean high end-of-life environmental disposal costs. High unreliability projections later in life also might be a sufficient argument to justify a higher first cost.

Using the IC/RC design model doesn’t guarantee perfect reliability. However, this model should reduce the cost of unreliability to an acceptable level.

Life-cycle cost analysis process

The life cycle cost methodology has 12 essential steps, which are detailed in the following paragraphs.

1. Define the problem: For the relatively simple case of a replacement for existing equipment, the problem might already be defined. That is, the plan might be to replace a worn out component that reached the end of its useful life. Somewhat more complicated is the replacement of equipment that isn’t meeting the need, whether it achieved its useful life or not. The key to this stage is having a clear understanding of the production requirements (throughput, load, expected reliability, etc.) and the required life. All stakeholders should agree upon these points as they dictate many of the decisions made in the life-cycle model. For existing equipment, verify the production requirements haven’t changed since the initial design to ensure you’re meeting the process needs.

2. Identify feasible alternatives: This is a critical step, particularly at the earliest design stages. It also is critical for replacements, because more is known about the operation and maintenance history. The mission variables should have stabilized unless the new equipment is part of a major upgrade.

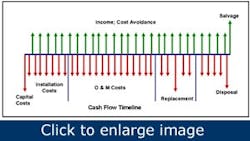

Figure 6. This is a schematic representation of the cash flow elements over an asset’s life.

3. Analyze the alternatives: The system requirements form the basis for the analysis. It’s appropriate at this point to prepare a tentative cash flow timeline (Figure 6). This requires an analysis of the total lifetime of events for the asset. If it is a purchased asset and not an in-house new design, the research, development and production costs will appear as a share of the purchase price. One of the most difficult pieces of information to acquire or forecast in most organizations is the revenue expectation. The revenue can appear as direct revenue or as savings or a combination of both. Finally, salvage value is considered part of - and actually reduces - the disposal costs. A close working relationship with the finance and accounting groups helps clarify the issues.

4. Cost breakdown structure: The cost breakdown is based on a cost model that shows cost factors and estimating relationships such as:

- Hourly wages

- Profit margins

- Material and energy consumption

- Repair costs

- Spare parts consumption

5. Develop a cost model: The cost model includes the basic information in the cost breakdown and the information received from the supplier. Sources of estimation error, such as future environmental or disposal costs, should be part of the model. Generally, estimated future costs should be presented as low, high and expected future costs to minimize the range of LCC uncertainty.

6. Lifetime event costs: Estimate or verify construction, installation, training, start-up services and all of the other event costs. Don’t overlook the estimated costs for writing standard operating procedures, recordkeeping and permits.

[pullquote]7. Financial analysis of future costs and revenues: Because revenue, savings and costs occur at intervals throughout the asset’s life, consider the potential for inflation. Usually, each company has an inflation index or base cost index it uses for these analyses. Using the same assumptions for every comparison validates the analysis. If the results are sensitive to inflation, use a parametric study.

8. Financial analysis of discounted cash flow: For the same reason that inflation must be considered, the present value of future payments, savings and revenue must be discounted to a common base period. This provides discounted cash revenue value and cost stream of payments so that the options can be compared directly. This is another area where a close working relationship with the finance and accounting groups is beneficial. Some companies require these analyses to be done by the finance and accounting departments.

9. High-cost items: Try to identify the high-cost contributors to the analysis. The list generally follows a Pareto distribution - 20% of the factors account for 80% of the costs. These line items are worth another review. Is there a better, cheaper way without sacrificing reliability or mission variables? What value should be assigned to this alternative if there’s a tradeoff to be made?

10. Sensitivity analyses: Because a number of the variables entering into the LCC model will be estimates with a range, determine the sensitivity of the IC/RC values to these estimates. Where possible, use the low, expected and high values to perform the test. However, it is also prudent to re-check the results if some values are low and some turn out high, especially on the cost side.

11. Tradeoffs: These change the level of risk involved. Use risk analysis techniques to assess the effect:

- Balance the levels of reliability and maintainability

- Develop the most cost-effective maintenance policy

- Choose between alternate assets

- Decide whether to modify or repair an asset

- Decide whether to retain or dispose of an asset

12. Select the alternative: This is where the work pays off. Recommend the alternative that best meets the mission parameters, cost basis and overall reliability. Be certain to document your assumptions and uncertainties.

The life-cycle cost analysis requires close cooperation among the parties involved in procuring the asset. Production specifies the product requirements, engineering does the design work and maintenance provides reliability records for the same or similar equipment. The analysis of life-cycle cost alternatives involves a team of people, including finance and accounting. Finally, the procurement organization ensures that the requirements are factored into the purchasing documents. Overall, the LCC process helps raise overall reliability at an optimized cost.

William D. Conner, III, CMRP, P.E., is a senior project manager for ABB Reliability Services North America. He can be reached at [email protected] and (713) 876-9269