Asset lifecycle management

When it comes to managing capital assets effectively throughout their lifetime, there are many barriers to overcome. One of the most formidable roadblocks is the silo-thinking of decades past, both for software tools and the people responsible for using them. In recent years, as companies begin to think more strategically about their assets, demand for a more integrated approach has steadily increased.

Furthermore, rising asset cost and complexity have resulted in a surge in operational and financial risk, such as the consequences of catastrophic failure. In turn, this has intensified pressure from shareholders and regulatory bodies to improve lifecycle costing and reporting. Fortunately, opportunities exist for better managing your assets throughout their lifecycle.

Asset lifecycle integration: The asset lifecycle has eight main stages, each with people silos responsible for them, and technology silos they might use:

- Strategy/plan: Depending on the industry, senior management develops a long-term capital plan that includes replacement of aging assets, as well as new assets that accommodate growth and an ever-changing strategic plan for the overall corporation. Software tools: capital asset planning software; strategic planning software

- Design: Execution of the Stage 1 plan begins with the design phase, where internal or external engineering resources are responsible for the design of new or replacement assets. Software tools: Computer-Aided Design (CAD); Computer-Aided Engineering (CAE)

- Build/procure/acquire: Once stakeholders accept a design, the asset is built, purchased or acquired through the efforts of the procurement department using external vendors. Software tools: CAD; Enterprise Resource Planning (ERP) Fixed Asset Accounting and Procurement modules [pullquote]

- Installation: Internal engineering, operations and maintenance resources work with external vendors to install and test the asset. Software tools: ERP Fixed Asset Accounting module; CAD; project management; various off-the-shelf and asset-specific quality assurance and testing software

- Operation: This stage provides the greatest source of revenue, and ultimately, the return on capital employed. It’s the longest and most expensive stage in an asset lifecycle, most often managed by the Operations Department. Software tools: ERP Material Requirements Planning (MRP) and other operational modules; shop-floor data collection; Human-Machine Interface (HMI); Supervisory Control and Data Acquisition (SCADA); Programmable Logic Controller (PLC); Building Management System (BMS); a wide variety of asset-specific, proprietary software

- Maintenance: The Maintenance Department is responsible for maximizing the availability, reliability and performance of the asset at minimal cost during the Operation stage. The Maintenance stage is interspersed throughout the Operation stage, such as whenever there is a breakdown, during planned shutdowns, for periodic preventive maintenance inspections and so on. Software tools: CMMS

- Modification/refurbishment: From time to time, a business need or technology change precipitates a modification to the asset by engineering, maintenance or an outside vendor (eg, to boost performance). Refurbishment simply brings the asset back to “good as new” condition, usually following a functional failure. Software tools: CMMS; CAD; ERP Procurement and Fixed Asset Accounting modules

- Disposal: The final stage of the asset lifecycle begins when an asset is no longer satisfying the needs of the business in a cost-effective manner or is at the end of its useful life. Engineering and Procurement Departments are typically involved in retiring assets. Software tools: ERP Procurement and Fixed Asset Accounting modules

As can be seen from these descriptions, the numerous islands of automation and various departments responsible for each stage make it difficult to integrate, manage and optimize asset performance along its entire lifecycle. However, the latest trend among the more sophisticated CMMS vendors is to provide more advanced functionality within the application that accommodates the business needs of each stage, either directly from within the CMMS, or through links to external software.

For example, several modern CMMS packages track “move history” of any serialized asset or component, from initial installation to disposal, including any appreciation or depreciation of the asset along the way. Some CMMS packages have an engineering module fully integrated with the maintenance modules for a smooth transition from design, build and installation, to operation and maintenance stages. Finally, the more robust ERP packages have fully integrated procurement, fixed asset accounting and maintenance modules.

Asset class integration: Not only do silos exist throughout the lifecycle of an asset, there also are silos for each asset class across the enterprise. The five major asset classes are:

- Plant equipment (eg, within a production line)

- Facilities (eg, buildings)

- Fleet/mobile equipment (eg, vehicles, fork lift truck, front-end loader)

- Infrastructure (eg, bridges, roads, pipelines)

- Information technology (eg, desktop computers, routers, handheld devices)

Each asset class might have a separate department responsible for maintenance, as well as a standalone CMMS specialized in each asset class (eg, a fleet-specific maintenance management system, a CMMS that can handle linear assets, specialized software for IT assets). When you couple these silos with those along the lifecycle of each asset class, one realizes the huge opportunity for improvement. Through enterprise asset management, resources and technology solutions can be integrated for each asset class, along the entire asset lifecycle and across the enterprise. This will dramatically reduce capital and maintenance costs. Moreover, using standard processes, definitions and software tools will provide economies of scale, as well as improve accountability and compliance.

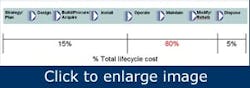

Effective lifecycle costing: The true cost to an organization of any asset is spread over the entire lifecycle, not just its initial purchase price. In most cases, much of the total lifecycle cost stems from asset operations and maintenance, for example, about 80% for facility assets. However, this isn’t the general perception, as indicated by the timeline scale used in the accompanying figure. Thus, when replacing an asset, the focus should be on selecting an asset and vendor that minimizes the total cost of ownership, not just the purchase price.

Contrary to general perception, most of an asset’s lifecycle cost (80%) stems from operations and maintenance.

Effective risk management: Even the most basic assets are becoming smarter with embedded technology such as RFID devices, sensors and onboard computers. Gradually, these assets are moving away from having standalone technology relevant only to the operation of the asset, such as onboard computers monitoring the status of a vehicle, and more towards technology that allows networking to other assets and some central monitoring capability. The benefits of smart assets abound, such as lower maintenance costs, increased asset availability and improved asset performance through condition-based monitoring systems built into the asset.

However, these benefits come with a price tag that reflects more than simply its dollar cost. The risks associated with these more complex assets have skyrocketed. As well, our dependency on the technology has dramatically increased. This is why virtually every industry has seen a dramatic rise in demand for better controls and reporting on assets by shareholders, regulators, unions and lobby groups.

As a result, you should develop rapidly-adaptable costing models that account for the risks and liabilities associated with each stage in an asset’s lifecycle. Anticipate the consequence of failure for the asset overall and each of its major components. In so doing, you can build a capital plan and lifecycle model that minimizes risk and supports appropriate capital funding through proper analysis of the options.

E-mail Contributing Editor David Berger, P.Eng., partner, Western Management Consultants, at [email protected].