Plant Services 2018 Workforce Survey: Manufacturers struggle to fill open jobs

For decades, the story of manufacturing in Massachusetts' Lower Merrimack Valley – one of the cradles of the First Industrial Revolution in the U.S. – was one of textile mills that gradually stopped running and manufacturing jobs that gradually went away. In March of this year, manufacturing accounted for 246,500 jobs in Massachusetts, down nearly half from 493,900 at the start of 1990.

The story was echoed at the close of the 20th century and through the Great Recession in other parts of the country where big, community-fixture factories were shuttering and manufacturing's status as an engine for local economic growth and a reliable source of family-supporting jobs took a hit.

It was a sad narrative. But it's not the current one.

“We had a call last week for a company that was looking for 10 students” to help fill its open manufacturing positions, says John LaVoie, superintendent of Greater Lawrence Technical School, a regional vocational high school based in Andover, MA. “We didn’t have any that we could send them because they were already out (working).”

Indeed, the 246,500 manufacturing jobs in the state this March represented a gain of 1% from the year before. And right now in the Lower Merrimack Valley, there’s an explosion of need for machinists and electronic technicians in particular, LaVoie says. Greater Lawrence is working to address that need through its machine tool technology and metal fabrication high school curricula as well as through training partnerships with area manufacturers looking to upskill their employees. In addition, working with the governor’s office, Greater Lawrence and another regional technical high school recently developed a curriculum for an advanced manufacturing certificate program that will offer evening courses to make it more accessible to adult learners.

Currently, “For every student that we put to work, we probably have four openings,” LaVoie says. Or as Ritch Ramey, engineering director at RAMTEC, a Marion, OH-based public-private partnership that provides training and certifications in robotics and advanced manufacturing, told attendees at the Automate trade show in Chicago last year, “We hear it all the time: I’m one maintenance technician away from having to shut my plant down.”

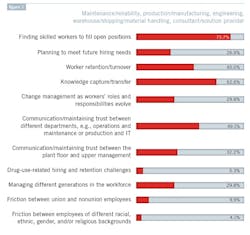

That need for workers now is perhaps the most salient finding of Plant Services’ 2018 workforce survey, in which more than 270 readers participated. Asked about their organization’s biggest workforce challenges, more than 70% said finding skilled workers to fill open positions is a top challenge.

Filling open jobs was far and away the top pressure point cited, ahead of such issues as retention/turnover (45% indicated this is a top challenge), planning to meet future hiring needs, or managing different generations in the workforce.

To be sure, there’s a good amount of interplay among the workforce challenges facing manufacturers. The No. 2 challenge identified, knowledge capture/transfer (cited by 57% of managers/supervisors and 63% of those in nonsupervisory roles), is a struggle for manufacturers looking to hang on to longtime employees’ technical and institutional know-how while also working to accelerate digital initiatives and showcase to potential new workers how leading-edge their organizations are.

Even issues less likely to be cited as a top challenge – drug use or friction between workers from different backgrounds, for example – can have meaningful impacts on a company’s retention efforts and quickly exacerbate a talent shortage.

But in Massachusetts, as in Tennessee, and as outside Chicago, manufacturers’ labor pains increasingly are growing pains, and that’s a positive change for a still-evolving, still-dynamic industry. The Institute for Supply Management reported in May that manufacturing employment is expected to increase 1.8% by the end of 2018 compared with the same time last year. (Textile mills, in fact, ranked No. 3 among 12 manufacturing sectors in terms of the employment growth they expect to see in 2018.)

The numbers – or what workers see in their own organizations – seem to be resonating with the current workforce: 37% of Plant Services’ workforce survey respondents said they’re more confident of their job prospects than they were in 2015, and 42% said their confidence is about the same. Moreover, respondents overwhelmingly indicate they’re happy right where they are: 78% say they’d be happy to remain with their current organization in two years.

What workers would like to see more of from their organizations, though, is opportunities for employees to learn new skills and support for helping them advance in their careers.

Following are perspectives from individuals across the country who are working to address manufacturing’s workforce challenges, as well as survey findings that point to areas of workforce opportunity for U.S. manufacturers.

Help!

“We can’t beg for enough help,” says Alex Ivkovic, information technology director at CDF, a Plymouth, MA-based maker of plastic packaging. Like Greater Lawrence’s LaVoie, he’s well-acquainted with the manufacturing labor crunch in Massachusetts. “We’re in an extremely expensive, extremely tight labor market,” he told an audience of analysts and media members at the IFS World Conference in Atlanta in May. “A lot of our product delays are caused by not having enough people to run the machines.”

As seen in Figure 1, there was agreement among supervisor/manager respondents and nonsupervisor respondents to Plant Services’ 2018 workforce survey that finding skilled workers to fill open positions is the top workforce challenge that their organizations face. And, LaVoie notes, the skilled-worker shortage has implications beyond putting current production targets in jeopardy.

“That’s holding back companies from purchasing equipment, because they don’t have the workers or the skills … people that can actually program and utilize the equipment,” he says. Alternatively, observes Guy Loudon, president of the Chicago-based Jane Addams Resource Corp. job-training organization, some companies are “sinking an enormous amount of money” into buying new equipment, “but then they can’t run it, or they can only run it one shift, and they’d like to be running it three shifts.”

JARC offers free job training in welding (including robotic welding), CNC machining, press brake operation and more for low-income and unemployed adults as well as an industry-targeted program that offers incumbent worker training. Extending and enhancing partnerships between technical high schools, trade schools, community colleges and adult-focused workforce development organizations and the industries they serve locally is crucial, LaVoie and Loudon say. The stronger the partnerships, the better the training providers can tailor their offerings to help meet manufacturers’ areas of greatest need.

“If there’s a company that has 15 workers they want to train in any particular kind of machine, anything from a CNC lathe to a CNC milling machine, we can do that,” LaVoie says. In addition, for high school students in the machine tech program, “We just bought a 5-axis CNC machine, so next year we’ll be training them in up to five axes, because we have a request from industry (for that).”

This more-collaborative approach is a shift for industry, acknowledged Paul Aiello, director of education at automation and robotics specialist FANUC America, in the same workforce session with RAMTEC’s Ritch Ramey at the Automate show last spring. “Traditionally, as manufacturers, we held a lot of our training and technology very close to our vest, but that has changed because we need students learning on current technology that is out there.”

Recruiting new workers who have desired hard skills is no small challenge in and of itself for many manufacturers; ensuring that potential new hires also possess the “soft” skills that can be vital to their success in an organization is an additional frustration, says Eric C. Horton, program manager of Operation Next.

“That’s an overwhelmingly common mantra that I hear every single day,” Horton says. “I’m meeting with HR reps from companies every day, and they all say the same thing: Those soft skills just aren’t there.” Operation Next aims to help employers address that issue via hard-skills training for a labor cohort already known for discipline and punctuality: military veterans.

Operation Next, which launched at Kentucky’s Ft. Campbell in 2017, looks to identify soldiers interested in earning industry credentials – ideally doing so about six months before the soldiers’ exit from active-duty service – and then get them online and hands-on training in CNC machining or industrial technical maintenance. It’s a venture that’s the work of Lightweight Innovations for Tomorrow (LIFT), a Manufacturing USA Institute and several partners, including the National Institute for Metalworking Skills and the Tennessee Department of Labor and Workforce Development.

“The heart of it was, (veterans) have the soft skills; they don’t have the certification skills; how can we do the right thing by veterans and do this for them?”

Hiring veterans is a logical solution, Horton says, from the perspective of several industry partners working with Operation Next. “(They say) I need veterans because they have soft skills,” he says. “They’re going to show up to work on time, drug-free, and be committed to working.” And for soldiers, trades training – even if it’s a matter of updating the skills they had before they joined the military – helps them transition safely out of the service, says Horton. Last year, Horton noted in a recent blog post, the U.S. had an estimated 370,000 unemployed veterans. Operation Next “is a great program that is really doing the right thing,” he says.

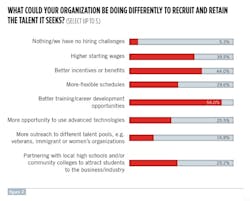

As both a recruiting and a retention tool, offering skills and career development opportunities is highly worthwhile, Plant Services survey respondents indicate. In fact, 56% of survey respondents said that better training/career development opportunities could help their organization be more successful in recruiting and retaining talent. Offering better career development opportunities, in fact, was the top thing respondents said their companies could do to improve recruitment and retention (see Figure 2) – ahead even of offering better incentives/benefits (44%) or higher starting wages (40%).

And for those who will comprise manufacturing’s next waves of executive leadership – the Millennials (the oldest of whom are now in their late 30s) and the Gen Xers who precede them – opportunities to move around are a top priority and can be a motivating factor to stay with an organization.

Whereas older workers may have readily proceeded along well-defined vertical paths within their manufacturing organizations, for Millennials especially, “it’s not necessarily about the next job; it’s what experiences are they getting and what skills are they gathering?” says Dawn Sprague, VP of human resources at San Leandro, CA-based application software provider OSIsoft. “Millennials really want to have different opportunities, and they want to explore different things, and they don’t want to be just stuck in one path for the rest of their lives,” Sprague says. “For us I think that’s very important to keeping these people engaged – (them) feeling like they have career development.”

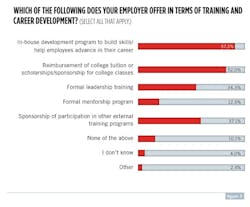

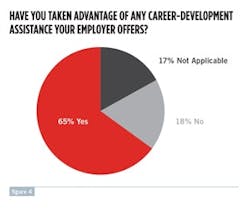

As seen in Figure 3, most respondents indicate their organization offers some type of in-house development program; tuition assistance is offered by just more than half. Thirty-seven percent of respondents say their employer will sponsor participation in external training programs. And as Figure 4 shows, 65% of survey respondents say they’ve taken advantage of career-development assistance that their employer offers.

Robot parade?

For CDF, the Massachusetts packaging maker, part of the labor-shortage solution has come in the form of robots and retraining. The “robotic experiment,” as Ivkovic described it, involved employing robotic arms to load plastic pouches as they came off the production line into totes. Previously, Ivkovic said, each production line required two employees just to perform that task.

Rather than being let go, the two affected employees were reassigned. “Not a single person lost their job over this,” he said. “It was simply…getting them to do something better.”

Robots and other automated systems allowing human factory workers to perform more value-added (and, for the employee, less-repetitive and possibly more rewarding) work is one lens through which to view the situation; the concept that if manufacturers can’t obtain the human labor they need at the price they seek in order to grow their business, they’ll find a way to need less human labor is another. Plant Services survey respondents in any case aren’t exceedingly concerned that they’ll be automated out of a job anytime soon. Asked whether they’re concerned that automation of some/all of their responsibilities will affect their job, more than half (56%) of respondents said no. About one-third (34%) chose “maybe at some point, but not in the next several years.” Only 10% indicated concern that automation will have an impact on their job in the next three to five years.

And while change management as it relates to the evolution of workers’ roles and responsibilities is on readers’ radar as challenge within their organization, only about 30% of survey respondents rated it as a leading issue. More of a concern, especially for nonsupervisors, is communication and maintaining trust between different departments, e.g., maintenance and IT. For nonsupervisors, this was the No. 3-cited challenge; for supervisors and managers, it came in at No. 4 (slightly behind worker retention/turnover).

Perhaps of good news to managers, communication between upper management and the plant floor was less likely to be cited as a leading challenge, and managers themselves were more likely than nonsupervisors to rate it as a top concern.

Meet me in the middle

Managing different generations in the workforce – and the generalized profiles of Boomer, Gen X, and Millennial workers that that idea often brings to mind – didn’t loom as large as some might expect in terms of workforce challenges that readers identified. Just under 30% of survey respondents (supervisors and nonsupervisors alike) cited it as one of their organization’s top challenges.

Still, when friction between older and younger workers arises, it can have deleterious effects on productivity and overall morale, which can in turn threaten an organization’s retention and knowledge-transfer efforts. Part of the issue is that Boomers and Millennials have different learning styles, says OSIsoft’s Sprague.

“You have people coming into the workforce who are used to going to technology to learn things – YouTube or WikiHow or things like that,” she says. “You know, ‘I don’t need to be shown how to do things; give me a computer and I’ll figure it all out.’ Versus the people who have been doing the work a very long time and just know the sensors inside and out, so they can put their hand on a piece of machinery and tell you by the vibration that something’s going wrong.”

“They’re very different of ways of working,” Sprague adds, “and how do you get the knowledge that’s in the head of all these people who are very experienced into these new people coming in who are very impatient about having to learn that and the ‘old ways,’ so to speak?” At the same time, she says, “How do you also bring what they bring to the table in terms of technology and their ease of use of technology and get the more-experienced people to adopt technology in a more efficient way?”

Indeed, when it comes to the use of cloud-based platforms and mobile apps, for example, for real-time collaboration or to monitor whatever asset or service they want to monitor, “I don’t think Millennials would even think of it as technology, they think of it as just, ‘That’s what I do,’ ” said Cindy Jaudon, president of the Americas for IFS, in an interview at the IFS World Conference.

“I think Millennials sometimes get a bad rap,” she adds. “It’s not that they’re not hard workers; it’s just a different culture” that they bring to long-established industrial businesses, she says.

Millennials’ eagerness to master new tools and processes quickly – and to advance or move around in their organization as they do – may be running up against another workforce shift within their companies, Sprague suggests. “You’ve got a big group of Baby Boomers who are not retiring as fast as their predecessors had done,” she says, and that can potentially limit the number of opportunities for those farther down the seniority ladder to move up or to make the jump to a different ladder within the company.

Strategies for managing across generations was a hot topic during roundtable discussions at the OSIsoft Users Conference in San Francisco in April. Among the best practices identified, says OSIsoft’s Sprague, were pairing individual newer employees with a more-experienced mentor. Besides facilitating knowledge transfer, mentorship – even in the form of informal pairings of senior personnel with junior employees – can help break down generational generalizations as workers get to know each other on a more-personal basis.

Acknowledging generational differences head-on is another option for organizations. One of the companies participating in the roundtable discussion, Sprague says, sends teams of employees to training on how to work with members of different generations. More-senior staff receive training on how to work with their younger counterparts, and vice versa.

Common threads for manufacturing's future

In Massachusetts, the past begets the future, in ways likely unimagined as manufacturing in the commonwealth reeled some 27 years ago. Last summer in Cambridge, MA, a new public-private partnership focused on so-called smart fabrics opened the doors to its headquarters just off the Massachusetts Institute of Technology campus.

Advanced Functional Fabrics of America (AFFOA) is a $317 million venture supported in part by the U.S. Defense Department and the eighth Manufacturing Innovation Institute to launch across the country. Its aim, according to MIT, is to seize upon advances in fiber materials and manufacturing to propel textile manufacturing for a new century. “These new fibers and the fabrics made from them will have the ability to see, hear, and sense their surroundings; communicate; store and convert energy; monitor health; control temperature; and change their color,” MIT stated in a news release.

The 32 universities and 72 manufacturing entities that are among the partners on board with AFFOA will look to develop not just smarter fabrics but also the workforce needed to produce them. That’s where Greater Lawrence Technical School comes in. “We are developing the curriculum to train future workers of this area,” LaVoie says. “Lathes and milling machines, looms and sewing machines, all very highly advanced, where your fabric is technology-based,” he says.

And while current manufacturers in the Lower Merrimack Valley are feeling the pinch in filling their workforce ranks, and LaVoie is feeling the pinch when it comes to recruiting teachers, signs are positive again for manufacturing in the region. More young people, too, are coming to appreciate the opportunities available in manufacturing today, LaVoie says.

Still, there remains “a real need to inform the public, the world what the industry is all about today,” he adds. “There’s still a lot of work to be done.”

Online exclusive: "Expanding and maintaining diversity in manufacturing: Ideas and best practices."