Design for reliability: It sounds like such an obvious concept – smart design from the get-go can help end users avoid asset failure, thereby keeping maintenance costs in check and reducing total cost of ownership. But how can you identify the products that will, by design, be the best fit for your plant?

You start by defining exactly what your goals for a given asset are and then identifying original equipment manufacturers (OEMs) that have the capabilities, expertise, and experience to design, build, and deliver physical assets that will perform beyond stakeholders’ expectations, that’s how.

Identifying all of the stakeholders and their interests is critical to accomplishing this objective. Not identifying all of the relevant parties and individuals may be the biggest mistake project managers make across the board to jeopardize the long-term performance and lifecycle costs (LCC) of the assets their capital projects introduce.

If you limit the stakeholders identified at the “initiate” phase of a project, the user requirement specification (URS) and supporting engineering specifications and standards will lack the depth to represent all of the project’s users and objectives. When tunnel vision sets in at this early phase of concept and design, focusing on the traditional cost, scope, and schedule to define a project, the opportunity to raise the bar on the LCC and long-term performance is often lost before it’s even defined.

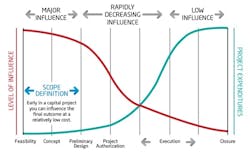

As Figure 1 shows, the level of influence is greatest at the earliest phases of the project. This is why it’s so critical to ensure that all of the interests, functional requirements, and user requirements have been gathered from everyone affected throughout the asset’s life.

Stakeholder identification and analysis

The pool of stakeholders extends far beyond the internal departments represented within the buyer’s organization. OEMs, contractors, vendors, and other outside suppliers represent a group of external stakeholders often not invited to participate in the project. What opportunities are missed as a result of this oversight? For one, the organization misses the opportunity to have this group of professionals apply their expertise to a project and work collaboratively to meet all of a project’s objectives.

A tool carefully constructed to identify the OEMs, contractors, vendors, and suppliers that can partner at this level is the request for information (RFI). The RFI should be used to inquire about the capabilities, expertise, and experience a company offers to qualify it as worthy of receiving a request for proposal (RFP).

A thorough stakeholder analysis defines stakeholders and their interests, attitudes, and concerns. But it does more than this: It explores opportunities to leverage the project team’s expertise to solve potential problems. The more the project team can be engaged and have ownership of the project up front, the more likely team members will be to contribute their expertise and innovations.

Request for information

An RFI is an inquiry into the standard practices of a company in order to quantify and qualify its capabilities and desire to take a project from concept to operation and deliver the value and performance the project requires. The questions should be open-ended and shouldn’t be leading to allow each company that responds to demonstrate what it typically brings to a project and partnership. The RFI will determine who will be invited to respond to the RFP.

Recognizing that the biggest opportunity lies in being involved in the design and selection of the system/equipment, identifying the OEMs that are most willing and capable of participating and contributing at this early phase provides a strategic advantage and value to the overall project. Consider that:

- As many as three in five failures and safety issues can be prevented by making changes in design1

- 80% or more of a facility’s lifecycle cost is fixed during the plan, design, and build phases2

- 30%–40% of equipment breakdowns are related to poor equipment design or condition3

Identifying OEMs, suppliers, vendors, and contractors with expertise in the maintenance and reliability profession that can translate their expertise into the equipment, options, documentation, training, and services they supply is paramount to achieving the goal of each capital project. In developing the RFI, consider requesting information pertaining to a company’s ability to support requirements pertaining to an asset’s lifecycle.

Give respondents the opportunity to differentiate themselves from their competitors. Also, consider closing the RFI with the following questions:

- What projects have you delivered and industry contributions have you made that demonstrate your cutting-edge leadership in delivering an asset, system, project, or process designed to achieve all aspects and interests delineated in this RFI?

- What expertise do you have with integrating predictive maintenance technologies into your designs?

- How does your company integrate the expertise of each of the functions supporting the concept, design, build, and ongoing performance of the solution you are proposing? How does your company represent these functions and capabilities in a unified approach as a stakeholder and partner for a project such as this one?

- What options do you offer for the solutions you provide, and what options are you developing? What driving factors are there behind these options and offerings? What new failure modes might these new options introduce and what mitigation strategies are you applying to address them?

- What hasn’t been asked that you’d like to share in order to highlight your ability to meet or exceed expectations on this project?

Before the RFI is sent out, nail down clear RFI expectations and criteria among procurement, engineering, quality, production, automation, and maintenance and reliability teams. Once responses are received, a formal review, such as a decision-diagram matrix of the returned RFIs, should be performed to rate responses and the importance of each of the criteria. A quantitative score should be tallied for each response, with a minimum score agreed upon as a threshold for moving an OEM, supplier, vendor, and/or contractor to the RFP phase.

The RFI is often the missing tool at a project’s concept/initiate phase to eliminate unqualified OEMs, preventing the wasted time of casting too wide a net with the RFP. Bring out the best in your OEMs, suppliers, vendors and contractors by giving them the opportunity to reply to an RFI.

Project management phases and front-end planning

Before moving on to the RFP phase, let’s explore a critical process that needs to be in place in the buyer’s organization to make sure that the best solutions that OEMs, suppliers, vendors, contractors, and other stakeholders present are given due consideration. The traditional five phases of a capital project include initiate, plan, execute, control, and close, as depicted in Figure 3.

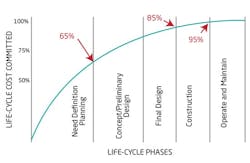

A structured front-end planning process incorporated into the project lifecycle processes provides the structure to ensure that these tools are applied. Front-end planning involves developing sufficient strategic information for owners to address risk and decide to commit resources to maximize the chance of a successful project. This process encompasses three subphases: feasibility, concept, and detailed scope. In many organizations, each of these phases is checked at “phase gates” that must be passed or approved before moving to the next phase.

As depicted in Figure 4 (per the Construction Industry Institute), front-end planning generally ends at phase gate three with project approval to move into detailed design and construction. The front-end planning subphases are preliminary to the execution and project closure phases.

Request for proposal

The most important document to prepare after the RFI is the RFP and all the supporting documents it comprises, including the URS. The URS typically establishes the project’s known requirements; however, it often neglects to include the specifications and standards of many of the stakeholders that will operate, control, maintain, and monitor the project over its entire lifecycle. A successful URS will specify:

- A team of operators, technicians and other key stakeholders who will be responsible for operating and maintaining the assets to contribute their recommendations and requirements as input through the design phase, starting with the URS

- How known concerns and limitations of current similar systems will be leveraged (you can do this via interviews with operators and technicians, analysis of CMMS data for like equipment to identify repeat failure modes and spare parts concerns, and detailing the specifications for maintenance, production, sanitation, etc., at the facility (or facilities) in which the project is being initiated

What should you include in the URS or engineering specifications and standards (or as supporting standalone documents)? Some advice:

- Engineering specifications should include the standards that production, maintenance/reliability, and quality teams adopt to remain consistent with the common spare parts, training, work plans, and theory of operation in place

- Engineering standards should include details that support the company’s condition monitoring, predictive technologies, evidence-based maintenance, automation, and instrumentation requirements

- Autonomous maintenance requirements for operator involvement should be included, with an emphasis on settings vs. adjustments for any tooling that changes with sizes or products

- Precision specifications should detail required tolerances, torque, alignment, and balancing standards for technicians

- An asset database for commissioning and validation activities, leveraged with procurement and maintenance and reliability requirements, should be specified to minimize repeat data and incorporate information from OEMs, contractors, integrators, and consultants

- You’ll want a maintenance mitigation strategy that is technically feasible and worth doing

- An OEM-experience-based maintenance strategy can reduce frequency-based maintenance and apply evidence-based predictive tools and techniques to monitor and trend performance unobtrusively

- Preventive and corrective work plans that incorporate required parts, tools, and instructions are a must to address failures when they occur

Design for Reliability (DfR)

During conceptual design, analytic tools such as DfR can be used to anticipate the expected failure modes and effects associated with different design configurations. The resulting information allows for a final design that promises the best performance of output, reliability, and lifecycle operating cost.

DfR is applied with the goal of designing out failure modes rather than mitigating them. This lets maintenance, reliability, production, quality, and engineering team members have their expertise and preferences in a wide variety of processes – including lubrication, condition monitoring, instrumentation and automation – reflected in working with OEMs on an asset’s design or configuration.

In addition, the following DfR attributes should be incorporated into layout and design:

Marie Getsug is a senior consultant for maintenance and reliability services with Commissioning Agents Inc. Contact her at [email protected].

Stephen Holland is global reliability engineer at Abbott Laboratories/Abbott Nutrition. Contact him at [email protected].

- Maintainability – the ability to access and maintain the asset’s components for maintenance and monitoring

- Reliability – the asset’s ability to run reliably

- Rig-ability – ability to rig the asset and its components (motors, agitator shafts, gear boxes, etc.) in and out after the initial installation, including tie off points designed for the equipment and the technicians accessing and maintaining it

- Cleanability – the ability to clean all areas of the equipment and maintain the classification of the area in which it resides, including inside the equipment

- Accessibility – the ability to access the components of the asset for the purpose of production, sanitization, sampling, maintaining, monitoring, etc.

- Operability – the ability to operate the asset with ergonomic layout considerations and minimized value mapping requirements

- Visual factory – the application of 5S and Total Productive Maintenance (TPM) autonomous maintenance concepts such as marked gauges, standards in colors, schemes, automation, physical layouts, etc.

Many times the above criteria are accomplished using a checklist of review items for each phase gate to ensure that all standards and concerns are captured and addressed for each new asset and system.

Next month, we’ll look at the criteria and tools necessary in making final vendor decisions, and working with your chosen partner to design and implement workable, reliable, cost-saving solutions.