The computerized maintenance management systems (CMMS) and enterprise asset management (EAM) software marketplace is no place for the uninitiated. With more than 100 packages from which to choose, finding software that’s just right for your plant can be an awesome task. Solutions range from small, local vendors that sell simple, shrink-wrapped CMMS packages for less than $1,000, right up to some of the largest companies in the world selling sophisticated, multimillion-dollar software designed for complex international enterprises.

I’ve conducted this CMMS/EAM software review annually since 1987 (published in Plant Services since 1997), and have observed many changes over the years. Computerization isn’t a panacea, but there’s one consistent theme I’ve seen year after year: A genuine desire to improve a company’s bottom line, through features and functions that increase the accuracy and timeliness of information available to those on the front line and their managers. With better information available sooner, people can react quicker to suboptimal situations. This ability eventually translates into greater asset availability and performance, improved asset reliability, higher and more consistent quality of output, and a lower asset life cycle cost. In turn, this means a lower cost of doing business and higher return on capital employed.

Year after year, hardware, software and telecommunications capabilities continue to improve dramatically, albeit at a slower pace now than the early years when computers first appeared. During the past three decades, the big surprises are:

- The comparatively poor 70% rate of adoption of CMMS packages

- The relatively constant 50 % failure rate in implementing them

- An inability to exploit the CMMS features and functions after they’re implemented (about 35% average utilization)

- Continued resistance to changing the attitudes, behaviors and procedures the CMMS functionality supports, which results in less-than-optimal bottom-line improvement (more than 80% of companies don’t even track CMMS cost versus savings).

Executives see big opportunities

So, as our technology improves, it appears human nature doesn’t. Although this revelation shouldn’t astound anyone, it never ceases to amaze me just how often we fall into the same traps, company by company, implementation after implementation. Even organizations now working on their third- and fourth-generation CMMS struggle with getting the most out of this investment.

In my view, this will surely change sometime in the near future for one simple reason: We’re running low on big ways to improve corporate profitability, and the CMMS enables one of the largest opportunities available. As more senior managers understand the potential bottom-line results, the focus and resourcing will shift to make more productive use of the CMMS.

There are many factors in play that weren’t as prevalent earlier, and hence weren’t driving senior executives to focus on their assets. Some of the more significant factors that caused the shift in attention in the corporate suite are:

Economic downturn: A weakened economy means senior executives are scrambling to satisfy profitability targets that shareholders demand. Typically, in bad economic times, companies spend less on maintenance, which produces even greater pressure to get more out of existing assets with less money to spend.

The Green bandwagon: Under the banner of green, asset sustainability, corporate social responsibility (CSR), conservation, climate change and so on, senior executives have had to show their employees, customers and shareholders that they’re doing their part to make the world a better place. When it comes to asset management, however, this isn’t about lip service. An increasing number of executives discovered that saving the planet and saving money aren’t necessarily mutually exclusive.

In fact, more informed leaders have found more money in asset sustainability than in traditional savings from a CMMS. This is especially true for asset-intensive companies. The annual market for MRO in the United States is about $100 billion, whereas the average spend on energy is about $300 billion. When the executive suite discovers that the CMMS can assist in better managing energy expenditures, as well as carbon and other emissions, expect a huge spike in corporate attention and action.

Heightened risk: Regulatory pressure and risk mitigation go hand-in-hand with asset sustainability. If top management doesn’t understand or embrace change that stems from sustainability, they’ll eventually be dragged into it by legislation or actions to avoid risk exposure. As the world becomes more complex, thereby increasing risk, and as executives learn that avoiding risk can mean avoiding jail time, there’s a shift in senior management’s attitude toward better management of critical assets. This means better planning, monitoring and control systems that predict and prevent catastrophic consequences such as asset failures, environmental upsets and health and safety risks.

Aging workforce: As baby boomers age, a large chunk of our most knowledgeable workers will be gone in a relatively short time. Numerous studies point to the issues surrounding an aging workforce, yet little action has been taken. However, as the talent loss becomes more acute, it’s likely that senior management will have an increased interest in capturing that disappearing knowledge in the form of best practices, procedures, standards, measures, equipment history and so on, using the CMMS as a data depository and knowledge-management tool.

Thirst for change: Every senior executive looks for one or more major change initiative that can demonstrate his or her leadership, motivate employees to focus on common goals and objectives, increase profits and, of course, leave a legacy. Some of the more common initiatives are Lean, Six Sigma, corporate social responsibility (CSR), reengineering the organization, merger/acquisition activities or capital expansion. With so much at stake, top management relies more on technology as a means to better plan for and track the success of these initiatives.

Modern CMMS packages are excellent enablers for most initiatives. This is especially true because of their high level of integration with other systems from shop-floor data collection, to engineering design, to ERP and corporate decision-making software tools. To assist in this goal, many vendors have added functionality such as business intelligence and dashboards, handling Balanced Scorecard, sophisticated notification and workflow capability, and highly configurable forms and reports management.

In light of these factors, I feel that executive focus is the single biggest change that will take place during the next few years, as top management scrambles to satisfy profitability targets. This heightened level of interest leads to increased support for maintenance, engineering and operations as they struggle to better manage assets across the enterprise, using the CMMS as an important enabling tool. To be successful and catch this next wave, savvy organizations will have an asset-management strategy in place, complete with corresponding policies, optimal procedures, and fully integrated technology infrastructure to support the processes, all of which meet the requirements of key stakeholders. Stakeholder buy-in and change management are the most important but most elusive critical success factors in our quest for cheaper, faster, better.

Essential versus full functionality

Although increased senior management support for enterprise asset management and the CMMS is one of the most influential trends, there are other trends worth noting. One is the age-old but continuing battle over the hearts and minds of the CMMS user community in terms of functional requirements. Since CMMS software was first invented, companies have prepared specifications for comparing and selecting the CMMS vendor that best fits stakeholder needs at an affordable price. This was crucial in early years because CMMS packages were quite rigid and limited in function.

In more recent years, the software has become flexible and highly configurable. Furthermore, it’s typically built on a more open and robust architecture for improved integration and implementation. This means user requirements can dispense with obvious functionality and, instead, focus on the more specialized and critical organizational needs.

The organization’s key task is to choose a CMMS vendor and package that provides the best value-for-money proposition, now and well into the future. After all, at some price points, and after considering the cost and pain of implementing the package, there will be huge reluctance to move to another solution for many years to come, even if the implementation was deemed a failure. The two main components of the value-for-money proposition are function and pricing. For example, a small standalone consumer goods manufacturer with 10 maintenance personnel spread over three shifts in one plant will have a different view of value for money than a large mining company with 30 facilities and 750 maintainers around the world.

Today’s packages are priced with greater flexibility in mind, such as paying up front per named or concurrent user, paying per month per user for an ASP or hosted solution, paying an all-inclusive subscription price, paying by metered activity (eg, energy usage), or paying for performance such as a percent of savings. Some packages have different pricing levels for different types of users (eg, administrators versus full users versus work requestors).

Regarding user requirements, many organizations will say that they’re only interested in essential or basic functionality. This means simple work order control, preventive maintenance, spare parts inventory control and equipment history. In some cases, this is a starting point, and the company will eventually demand greater functionality in one or more of these areas. In other cases, the value-for-money proposition is such that there is no business case, perceived or real, for adding more features.

Because there’s considerable differentiation of CMMS vendor offerings along this dimension, the Plant Services CMMS/EAM Software Review online tool has been upgraded to allow users to select either “Essential Functionality” or “Full Functionality” (see www.PlantServices.com/CMMS_Review). If you’re interested in comparing packages on the basis of price and essential functionality, the online tool pre-assigns weightings that zero out advanced or specialized features such as handling linear assets, fleets, compatible units, calibration, encumbrance accounting, service level agreements, lockout/tagout, advanced warranty handling and many others. At the same time, the tool increases the relative weighting for price.

Those with less price sensitivity who wish to compare full functionality can assign equal weight to every function by selecting the “Full Functionality” option. For a list of the attributes whose weightings can be adjusted, in whole or for any individual feature/function within a given attribute, see the sidebar, “Software aspects examined at www.PlantServices.com/CMMS_Review.”

Of course, there are applications and CMMS vendor offerings that sit somewhere between these two ends of the functionality spectrum. Starting from either the preset weightings of the “Full Functionality” or “Partial Functionality” options, you can adjust weightings to turn on or off features to match requirements. For example, one application might not require full functionality but calls for the essential functionality plus a fairly sophisticated calibration module, or advanced inventory management features, or features appropriate for the pharmaceutical industry, or specialized functionality for the maintenance of facilities or fleets.

To find appropriate packages, users of the Plant Services CMMS/EAM Software Review online tool can start with the preset weightings of the “Essential Functionality” comparison and later increase the weightings of any of the zeroed out features (eg, turn on calibration functionality by changing the weighting of this attribute from its preset setting of zero, to say, 5% of the total weightings). Alternatively, you can start with the “Full Functionality” setting, and reduce any of the attribute or feature weightings to zero (eg, turn off functionality for encumbrance accounting and compatible units by setting the weighting of these attributes/features to zero).

“Single vendor” versus “best of breed”

One question I’m increasingly asked these days, especially for larger companies, is whether to adopt a “single vendor” ERP solution or a “best of breed” CMMS. There are essentially four options along this dimension. The first is a fully integrated ERP “single-vendor” solution, which has a maintenance module that can’t run or isn’t sold as a separate and distinct CMMS. At the other extreme is a standalone “best of breed” CMMS, which isn’t designed to easily integrate with any ERP packages.

The third and fourth options lie somewhere between these two extremes. The third option is an ERP package with a fully integrated CMMS module that can be sold as a standalone package, and the fourth is a standalone “best of breed” CMMS that can be integrated with one or more popular ERP packages.

Key advantages of the “best of breed” approach are:

- Wider and deeper functionality because the focus is on CMMS

- Better solution scalability

- Greater CMMS specialization and flexibility to add or configure functionality for any industry

- Less complexity and less reliance on other ERP modules to provide CMMS functionality

- It’s faster and easier to implement and upgrade the CMMS functionality

Key advantages of the “single vendor” ERP solution are:

- Single look and feel across modules

- Clearer accountability with only one vendor,

- Modules are seamlessly integrated with the CMMS module (eg, HR, CRM, ERP), for initial implementation and subsequent releases

- Facilitates standardization across the enterprise on underlying and connected technology such as operating system, workflow engine, GIS, mobile devices, document management system and reporting tools

Note that the third and fourth options might have important advantages from both camps, which is why they should be carefully considered for large enterprises.

Try the CMMS tool for yourself at www.PlantServices.com/CMMS_Review.

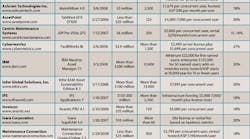

Click the chart below to enlarge it.