Plant Services 2021 Workforce Survey: Is the grass always greener?

When looking over the data from this year’s Plant Services Workforce Survey, I was reminded of the TV series Home Improvement, starring Tim Allen and featuring Earl Hindman as Tim’s neighbor Wilson. In episode after episode, Wilson was there looking over his fence, helping Tim solve problems but never once in eight years emerging into Tim’s yard. Wilson was content to be a trusted advisor who stayed in his own yard.

Nearly 200 maintenance and reliability professionals responded to our 2021 Workforce Survey, and the picture that emerged was of a workforce that is still in search of skilled people to fill open jobs, yet a workforce that at the moment at least is content to not take advantage of the job market themselves. Instead, MRO professionals are “staying in their yard” and engaging in professional growth and certification programs, which employers are providing in greater numbers than they were in 2019.

It’s hard to say whether this trend would be the same without the influence of the COVID-19 pandemic on people’s willingness to move to new or unfamiliar locations for the sake of a job. Read on and/or download the full set of survey data at https://plnt.sv/2109-WORK to explore for yourself some of the trends that emerged from this year’s survey.

Workplace satisfaction

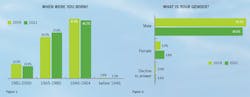

The first set of charts, Figures 1-6, are designed to communicate the level of job satisfaction that respondents are feeling, in addition to other basic demographic information. Figure 1 captures the continuing generational shift away from Baby Boomers and toward Gen X, Millennials, and Gen Z. This year’s survey did not reveal a sudden or significant change, but rather a gradual shift as more senior workers continue to find employment alongside their junior colleagues. In addition, Figure 2 shows the similarly slow and gradual progress being made by women entering the maintenance and reliability workforce.

The next four charts measure different facets of people’s current level of on-the-job of happiness. Figure 3 suggests that respondents are slightly more concerned in 2021 about their level of job security than they were two years ago; however, 66% of respondents reported that they feel either more secure or about the same as they did in 2019. That sense of confidence carried over into the responses in Figure 4, which indicate that people are slightly more confident this year in their company’s ability to respond to business challenges – 66% of respondents are as confident in the ability of their organizations to achieve success as they are in themselves.

Following those questions, a fuller picture of on-the-job contentment emerged from this year’s survey. When asked if people think they will be with their current organization in two years, a whopping 82% said “yes” (see Figure 5). Furthermore, when asked about the kinds of factors that would prompt them to consider leaving, only one jumped to the top of the list – better pay or benefits (see Figure 6). Every other factor declined in importance since our previous survey in 2019, and none came anywhere near the top response. In fact, “better pay or benefits” was cited by 76% of our respondents as the most likely reason they would consider leaving, and the next-most influential factor (“new or more-attractive job responsibilities” at 37%) was not even half as strong a factor as monetary compensation.

Given all the pandemic-related stresses of the past 18 months, this level of workplace contentment comes as somewhat of a surprise. It’s not as if overtime is a thing of the past, with 60% saying on this year’s survey that they work regular overtime hours. However, respondents also said that 77% of them are often asked to work on tasks outside their job description, which suggests that many respondents are exposed to enormous on-the-job growth potential.

Workforce challenges

The heart of our biannual Workforce Survey is the section on workforce challenges: what are the obstacles that respondents think are the greatest daily hurdles to success, and how well are organizations managing these challenges? This year’s survey turned up some familiar findings, with one big surprise.

When asked to select their biggest workforce challenge, the top answer was yet again “finding and recruiting skilled workers to fill open positions.” This has been the top answer since our first survey in 2015, and this year 74% of respondents cited this as a factor (see Figure 7). However, the interesting news is that respondents think it is much less of a factor this year than they did only two years ago, when 81% cited it. Close to half of this year’s respondents also think “retraining/upskilling existing workforce” is a pressing issue; and, taken together, it is clear that addressing the skills gap with available resources is very much on people’s minds. After all, the 2.1 million skilled industrial jobs predicted by Deloitte as going unfilled this decade are not going to fill themselves.

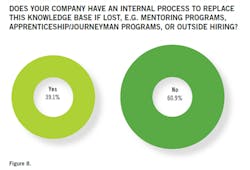

The big surprise this year was that the only workforce challenge that grew as a concern over the past two years is “knowledge capture/transfer,” growing from 49% in 2019 to 52% in 2021. A follow-up question may explain this concern: when asked if their company had internal processes in place to replace lost knowledge, only 39% said “yes” (see Figure 8). It’s also worth noting the sharp drop in the number of respondents who thought communication between upper management and the plant floor was a problem.

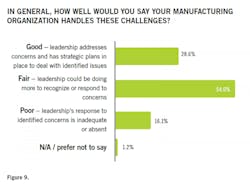

Survey respondents were more optimistic about how their organizations are handling these challenges. Nearly 30% said that they thought their organization was doing a “good” job, and 54% more chose “fair;” only 16% thought that leadership’s response was inadequate to the task at hand (see Figure 9).

Recruitment and retention

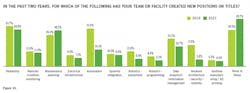

The next phase of the survey covered attitudes over worker recruitment and retention. We began by asking about new positions that have been created in the past two years, and were surprised to see that most job categories experienced a modest drop in creation (see Figure 10). Two IT-related categories (“automation” and “network architecture/security/mobility”) experienced sizable drops, suggesting that either facilities are staffed as needed in those two areas, and/or those functions are being outsourced.

It is telling, however, that the sole job category to experience growth since 2019 is “maintenance planning,” jumping from 26.3% to 30.1%. This jump not only complements anecdotal evidence that organizations and facilities are taking the planning function more seriously, but it also reinforces the data that emerged from our recent COVID-19 survey, which found the two greatest needs among plant teams over the past 18 months are “stronger health and safety program” and “stronger planning ad scheduling program” (read that full survey story at https://plnt.sv/2104-COVID).

Figures 11 and 12 capture what survey respondents think their organizations could be doing differently to recruit and retain workers, respectively. In both cases the top factor was “higher wages,” closely followed by “better benefits,” suggesting that workers may currently have both eyes looking over the fence, wondering exactly how much greener the yard next door might be, even as they tackle problems in their own yard.

In other questions on the survey, 64% of respondents did not think that the location of their plant was affecting their ability to recruit new talent. Respondents also indicated that recruitment is taking place primarily at recruitment events (53.9%), followed by four-year colleges (38.2%) and specialized recruitment firms (29.4%). However, Figure 11 shows that survey respondents still think organizations could be doing a better job partnering with local high schools and trade schools, as well as reaching out to other talent pools like veterans’ or women’s organizations.

One final finding in this section came as a surprise – yet it both aligns with data from prior survey questions, and adds important context to the next section of the survey that is more focused on professional development. When asked what organizations could be doing differently to recruit talent, the number of people citing “better promotion of training/career development opportunities” dropped significantly over the past two years, from 55.1% to 39.1%. What could explain this rise in positivity when it comes to employer-provided professional development? Read on...

Professional development

The final charts capture the kinds of professional development activities going on in the lives of our survey respondents. After an initial wave of questions that established people’s general reluctance to look around for better prospects, this final question set established that organizations are taking a vested interest in the culture and professional growth of maintenance and reliability workers.

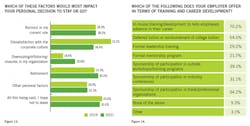

Figure 13 offered a surprise: after more than 50% of respondents in 2019 said that corporate culture would be a major influence on whether they would stay or go, only 36% said so in 2021. And on training, Figure 14 shows the types of training opportunities that are being offered. At the top of the list is various types of in-house training and development, such as OSHA refresher courses (70%); and a variety of tuition reimbursement programs (54.0%).

As for the types of training utilized by plants, there’s been a change in delivery due to the COVID pandemic: for the first time since we began this survey, more companies delivered training via eLearning (65%) than by in-person classrooms (59%). It will be interesting to see if this shift is permanent, given this year’s trend of remote work and remote asset health monitoring. However, the clear preference is for various kinds of on-the-job training (85%). It’s also worth noting that some respondents (30%) but not most said that their companies are delivering training in languages other than English.

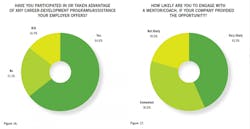

As for certifications, a glance at Figure 15 reveals a dramatic 4X increase in the number of respondents who said their company invested in their earning the CMRP certification, through the Society for Maintenance and Reliability Professionals (SMRP), as well as the CRL certification, through the Association of Asset Management Professionals. Figures 16 and 17 back up this interest in professional development, as 65% of respondents said they have taken advantage of career-development programs offered by their employers, and 80% would consider working with a company mentor or coach.

Also, the number of people reporting that their companies offer no types of support for certifications dropped since 2019 to less than half. These results dovetail with data presented on Figures 6 and 12, where only about 30% of respondents said that a lack of development or advancement opportunities at their current place of work was causing them to look at better opportunities elsewhere. Clearly, for companies that offer this kind of support to their teams, people are sticking with the yard they know.

In conclusion

This year’s survey is a snapshot of a maintenance and reliability workforce that is more content than usual with their work, taking career development opportunities when available and focused on specific on-the-job improvements such as knowledge capture/transfer and upskilling the existing workforce in order to keep good workers as well as the knowledge they have about managing asset health. About the only things on people’s wish lists are higher wages, better benefits, and greater recognition of on-the-job achievements, all of which are fairly evergreen concerns.

Is the grass greener at a different facility? Only you can answer that for yourself, but this year at least, people are taking the opportunity to appreciate where they are and what they already have.

About the Author

Thomas Wilk

editor in chief

Thomas Wilk joined Plant Services as editor in chief in 2014. Previously, Wilk was content strategist / mobile media manager at Panduit. Prior to Panduit, Tom was lead editor for Battelle Memorial Institute's Environmental Restoration team, and taught business and technical writing at Ohio State University for eight years. Tom holds a BA from the University of Illinois and an MA from Ohio State University