Managers, engineers and operating staff often face the question of whether to repair or replace a piece of equipment. Often there's disagreement. Perhaps the engineering staff feels strongly that paying for new equipment is justified, whereas those controlling the purse strings are convinced that running the old unit is less costly. It's possible to bridge that divide and educate decision-makers about a way to compare costs of repair versus replacement.This question is particularly important in the case of rotating equipment. Large compressors can be the single most expensive capital item in a facility. They consume a lot of utilities and can require significant maintenance.A decision tool called equivalent annual cost (EAC) can be applied to the repair-versus-replace question. EAC allows engineers and operators charged with optimizing the left side of the balance sheetassetsto speak a common language with managers, who tend to see the right side of the balance sheetliabilities and equity.Operating companies need to deliver strongly positive cash flows. Doing so depends on intelligent repair-replace decisions, which ensure the best use of a company's productive assets. Smart use of EAC to make decisions prevents cash wastage; it's a tool that can help engineers and managers achieve the best possible position for an operating company.

Net present valueThe concept of net present value (NPV) is important in assessing repair-versus-replacement costs. Consider the idea of an annuity. An annuity is a cash flow that pays the same nominal amount at fixed intervals for a long time. Figure 1 shows a graph of an annuity's nominal cash flows over time.

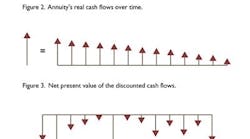

However, these are only nominal cash flows. Because of the time preference for money, each succeeding nominal cash flow has less real value than the one before it: nominal dollars don't equal real dollars. In other words, 10 dollars now is preferable to 10 dollars a year from now. The discounting process adjusts future cash flows to their present values. The discount factor is equal to:1/(1+r)t (Eqn. 1)where r is the interest or discount rate and t is time. Multiply a nominal cash flow by its discount factor to achieve the configuration shown in Figure 2.Net present value (NPV) encapsulates this series of cash flows into a single measure of the real total value of those future cash flows as of today. Figure 3 represents NPV as the sum of the discounted cash flows (DCFs).Using a single annuity factor simplifies the calculation. Finance and accounting books provide charts and formulas for annuity factors. Put simply, NPV = nominal cash flow times its annuity factor.CostsCosts are similar to annuity cash flows, except they have a minus sign in front of them. Not only are costs negative, they're often unstable. The nominal costs associated with owning a compressor might look like Figure 4.Future costs have less impact than present ones. In other words, you would rather pay 10 dollars in the future than pay those 10 dollars now. Relative arrow lengthsthe real value of the costsshrink over time when viewed from the present. Net present value encapsulates these costs. Figure 5 represents the compressor costs discounted and summed.Often, plants need to choose between two situations: keep an existing compressor or buy a new one. The problem with using NPV to compare decisions is that the maintenance world doesn't offer easy choices. The example timelines above were of the same length, but in the real-world, one compressor might have an expected 10-year lifetime and the other only a five-year useful life.So maintenance and service personnel face this question: Can something have the lowest first cost and need replacement more often, but still be a wiser choice? Because the timelines differ, we need a technique for comparing compressors on an equal footing.Equivalent annual cost (EAC), an idea related to NPV, achieves this. The beauty of the approach is its ability to compare dissimilar ownership cycles. Generally it's best to favor the compressor exhibiting the smallest EAC.If NPV = (payment x annuity factor), then payment = (NPV / annuity factor). Invert the annuity factor to get the equivalent annual cost factor. Rewritten, Payment = NPV(EAC factor) (Eqn. 2)Now, the decision becomes simple. If we calculate the cost NPV, we can say that there is no real financial difference if payments are constant year-on-year. Then we can compare one decision with another by noting its equivalent payments, or equivalent annual cost. Say that Compressor A has a nine-year life and Compressor B has a 12-year life. Whatever the interest rate, use the EAC factor corresponding to nine years for Compressor A and 12 years for Compressor B.EAC and compressorsAn example is the best way to illustrate. In this example, Compressor A is the existing machine. It has much higher operating costs than a new machine and much higher repair costs too, but it's completely paid for. Sometimes it trips, which stops production and adds to cost. This is reflected in the chart below. It will be replaced six years from now with a new machine.Compressor B is a new machine. It has lower operating and maintenance costs and won't cause shutdowns, but it's expensive and will be replaced in 10 years. Its only cost will be regular maintenance and energy.One group insists that Compressor A is less expensive. Another insists the company can't afford not to get a new machine, and a short time later, a new one must be bought anyway. Who is right?Let the EAC for Compressors A and B decide the issue. For this example, assume the cost of capital is seven percent. Tables 1 and 2 summarize the calculations.

Over a 10-year horizon, with cost of capital at seven percent, sticking with Compressor A appears to be the better choice because it has the lower EAC. This is an important finding: it's easy to claim that "it will nickel and dime us to death," but EAC shows what is really happening financially.Strategic considerationsEquivalent annual cost is a tool and, like every tool, it has limits. The numbers imply that Compressor Athe old compressoris a better choice. Yet, if the plant shutdowns that it causes also present a safety problem, this changes the landscape. Perhaps Compressor A is in a critical hydrocarbon processing service: shutting it down for one hour could result in costs of $100,000 or more. It's important that each cost element be taken into account when making financial and operating decisions.Purchasing Compressor B might provide an opportunity to increase production that would be impossible with Compressor A. Then Compressor B would have a real value the numbers don't capture. Similarly, if staff and management are aware that a planned process change in six months will turn Compressor A into a bottleneck, then EAC won't capture every cost and benefit of the repair/replace decision.Nevertheless, EAC is a useful tool for management and operations staff. It allows differing situations to be evaluated on a consistent financial basis. Though it can be arithmetically complex, many choices can be evaluated by discounting cash flows on a spreadsheet.Smart financial choices are crucial in today's operating environment. Selecting options on the basis of EAC can help guarantee positive operating cash flows. When teamed with smart, strategic decision-making, equivalent annual cost can become a powerful tool that promotes success on the plant floor. Figures: Core/Global ConsultingRobert A. Dunlap is the principal of Core/Global Consulting, Austin, Texas. He can be reached at [email protected]bs.utexas.edu and 512-423-2280.