A spring 2020 Plant Services / Fluke survey of 232 plant managers and other maintenance and operations professionals was conducted between April 28 and June 4. If the results are any indication, the following are the priority upgrades that maintenance and reliability professionals and their companies will focus on in the pandemic-recovery months ahead:

• More spending and rigor will be devoted to deep-cleaning workplaces and physical distancing. Personal protective equipment (PPE) will be in hot pursuit.

• Investments will be made as soon as feasible in technologies that automate data collection and enable remote asset management.

• Upgrades of existing computerized maintenance management systems (CMMS) or the implementation of new ones will be a popular topic.

While these ambitious projects can hardly be considered minor tweaks, regular maintenance practices themselves are not likely to significantly change, survey respondents said. When asked, “Has COVID-19 changed your normal maintenance mode?” a resounding 73% said no (see Figure 1). “Other than some enhanced cleaning procedures, we are keeping it the same as usual,” said one respondent about maintenance processes.

When asked, “Has the pandemic revealed any areas where your facility might need immediate assistance,” about one-third said “no” or “not at this time” or “no; it’s business as usual.” A smaller portion of respondents cited the need for help with securing more PPE, better sanitization resources and processes, and interest in digitalizing asset management systems.

The results of the 14-question survey suggest that many plant managers and operations leaders are already taking steps to mitigate challenges brought by the pandemic – and that a sizable share feel their situation is manageable.

At least a few admitted, however, they are not well equipped to withstand the slowdowns or shutdowns encountered, or the remote work requirements imposed by their companies. Some are also hurting from furloughs or layoffs.

Mixed picture on pandemic’s impact

We have learned from other articles, surveys, and intelligence that some industries are getting through the pandemic better than others. For example, the transportation sector, including automotive and aviation, has been slammed, though it appears on the way to recovery. Pharmaceutical and food and beverage, on the other hand, have been operating at a higher-than-capacity level overall.

In this Plant Services / Fluke survey, respondents were anonymous and not asked what industry or company they represented. Still, a mixed picture of how enterprises are faring emerged.

Nearly 31% of respondents said their plants are operating at standard levels, and another 13% said they are running at higher or full capacity. Meanwhile, 50% are operating at reduced capacity, and 6.5% are in a temporary shutdown (see Figure 2).

When asked, “How are your organization’s maintenance and reliability teams currently working?” (see Figure 3) the answers were split along these lines:

- 42% pretty much the same as regular times

- 25.5% with a skeleton crew on-site and most team members working remotely

- 24.5% with most team members on-site and a small number working remotely

- 4% doing maintenance almost entirely remotely (few or no team members on-site)

- 4% shut down at this time

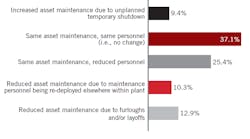

Also, a majority of 37% said they are performing the same level of asset maintenance with the same personnel. Another 25% said it is asset maintenance as usual, but with a reduced number of people (see Figure 4).

Almost 13% said they had to reduce their asset maintenance due to furloughs or layoffs, and another 10% decreased asset maintenance because team members had to be deployed elsewhere in the plant.

Maintenance teams assuming more responsibility for workplace sanitization

Given the pandemic, it is probably no surprise that in individual responses to several of the survey questions, respondents expressed an urgency to deep-clean their workplaces. “We have a dedicated decontamination crew,” said one respondent. Said another, “we have one staff member dedicated to sanitizing high-use areas. Providing sanitizing wipes for employees as needed.”

When asked, “Has the business slowdown revealed any of the following to be a pressing need in the area of asset management and maintenance?” the highest percentage, 42.5%, checked this answer: “Stronger health & safety program (including PPE inventory),” which presumably includes sanitization. The No. 2 response, “Stronger planning and scheduling program,” checked by 35.8%, could also include scheduling cleaning services, such as through a CMMS (see Figure 5).

Maintenance teams will likely be (and in many cases already have been) taking on more oversight related to sanitizing workspaces and disinfecting office counters, door handles, bathroom fixtures, and more. As more resources and spending are devoted to this activity, will it mean more maintenance jobs – or more specialized cleaning services jobs? This is clearly an area to watch.

With governmental regulations regarding workplace safety and sanitation possibly coming, many industrial companies are adhering to COVID-19-related guidelines developed by the Occupational Health and Safety Administration (OSHA), the Centers for Disease Control (CDC), and possibly other entities in the meantime. And employee satisfaction with company policies and practices regarding sanitation could become just as crucial to executives as any compliance requirements, as a few comments in the survey indicated. Employees could become influential in shaping a company’s image – and recruiting – when it comes to how clean and safe they view their workplace.

Having enough PPE (including masks) taking on greater importance

Of the survey respondents who admitted they did require immediate assistance, several mentioned PPE and noted their dependence on, what these days, is a fragile supply chain. Typical responses: “PPE supply shortages,” “PPE supplier reliability,” and “Sourcing of PPE (is urgent) as needs and requirements change.” Some referenced the need to get PPE supplies from different countries and cited complications due to travel restrictions and 14-day quarantine requirements for their distributors traveling internationally.

At the very least, many if not most workplaces will require on-site employees to wear masks. For plant employees working close to machinery, the PPE needs will go well beyond this. With an increased emphasis now on overall safety, employee requests for additional PPE should get more attention, but getting PPE delivered quickly or in the amounts requested may be a challenge.

Meanwhile, survey respondents also mentioned they’ve begun to temperature-check employees and space out people working on-site. Expect more spending on temperature screening and people-counting tools to limit spreading the virus and increase physical distancing.

Connectivity and the cloud will enable remote asset management

Depending on the industry, company, and size, many organizations are requiring employees that can work remotely to do so. This change has led to skeleton crews remaining on-site and practicing social distancing, and others working from home or somewhere else away from the plant.

CMMS software, cloud solutions, and other components of industrial internet of things (IIoT) platforms are helping many maintenance teams remain productive, as well as safe, during the pandemic. But survey responses show that some organizations are equipped better for remote work than others.

In the question regarding pressing needs related to asset management and maintenance (see Figure 5), 24.2% of respondents checked the answer, “Better digital platforms for data collection & analysis.” This response was the third-highest behind “stronger health & safety program” and “stronger planning and scheduling program.”

A different survey question asked plant leaders, “What technology needs are on your list to stay competitive – once disruptions due to the COVID-19 pandemic are past us?” IIoT systems enabling remote asset management, plus CMMS software specifically, were the most popular answers. Also cited were communication tools such as Microsoft Teams, automation software, security solutions, online training, and workplace-safety technology such as temperature-screening tools.

“We need digitalization: software and smart sensors to get data from machines and equipment to help reduce maintenance costs and also try to improve operational performance,” wrote one respondent. Another wrote “CONDITION MONITORING TOOLS” in capital letters.

However, several respondents noted that the financial damage caused by the pandemic will slow their companies’ spending. “Financial restraints will limit future purchases,” said one.

Though there are many companies eager to spend, technology investment overall is likely to be measured and cautious, according to a May 2020 article by McKinsey and Co., “Beyond COVID-19: Rapid steps that can help machinery and industrial automation companies recover.”

Implementing successful asset management programs with remote monitoring capabilities isn’t something that will happen overnight either, as maintenance and reliability expert Ramesh Gulati noted in a recent Fluke Reliability webinar, Lessons From The Pandemic: “You must have the right culture in place,” he said, “for a successful asset management program.”