- Leverage the service provider’s full capability.

- Link compensation to plant performance.

- Establish an atmosphere of cooperation and accountability.

- Ensure complementary business objectives.

Cost and performance

A recent study of Fortune 500 and International Fortune 1000 companies determined the three distinguishing characteristics of the best plants (Figure 1):

- Systematic failure elimination.

- Profit-centered maintenance.

- Strategic performance contracting.

| Outsourcing/insourcing decision logic 1. Generate list of activities or functions to consider. |

- Will you need to disclose intellectual property or proprietary knowledge critical to your ability to compete?

- Can the service provider cause an environmental or safety incident for which you retain accountability or that will risk your company’s reputation?

- Can you control service delivery effectively to avoid major throughput or quality disruption?

- Will outsourcing cause work force or bargaining unit conflicts or work stoppages?

If the answers reveal an unacceptable risk, discontinue consideration of the option. If the risks are acceptable, rate them. A high rating indicates that self-performing the activity has no risks, whereas outsourcing it has severe risks that must be offset with significant value to be justified. A low rating indicates that there are few risks from outsourcing the activity, and self-performing is undesirable. A mid-range rating indicates that the risks of self-performing the activity are comparable to outsourcing it.

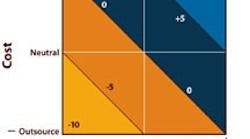

The third step is to assess the value of self-performing versus outsourcing along two dimensions: focus and cost (Figure 2). If outsourcing enhances your ability to compete, the activity plots on the left of the figure. In contrast, if self-performing the activity enhances your control of critical variables, the activity plots on the right.

To evaluate the cost dimension, ask whether self-performing provides you with a cost advantage. If the annual activity cost is a major portion of your budget and self-performing is a big advantage, the value of self-performing is positive and plots at the top of Figure 2. Conversely, if self-performing is known to be a cost disadvantage or if your competitors gain a cost advantage by outsourcing the activity, the cost of self-performing is a negative and plots in the lower half.

Figure 2 combines the cost and focus dimensions into a single value assessment. For example, an activity that provides a moderate level of focus at a slightly negative cost has a value near zero. Therefore it shouldn’t be considered by itself for a performance-based partnering scope. In contrast, activities that plot in the lower left are great candidates for partnering.

- If outsourcing, are there multiple suppliers readily available with suitable resources, qualifications and interest to support you?

- What will be needed to establish the skills and resources not readily available now?

- If significant assets are required to perform the activities, will excessive contractual commitment be required to outsource?

- Could you possibly liquidate assets for cash if you decide to partner?

Use the answers to rate the expected difficulty in making the transition. Apply a low rating for options that can pose major transition difficulties. Rate options high if you expect little to no transition difficulties.

The fifth step is to compute an advantage index for each candidate option having a transition rating. The advantage index is the product of the risk, value and transition ratings.

The last step is to sort and select candidates for partnering. Outsourcing options with a high advantage index offer the least risk and greatest value with the least effort to transition.

Contracting strategies

Not every outsourcing contract is an appropriate candidate for partnering or performance-based contracting. Contracting strategies for services vary according to business needs. Some contracts have lower initiation cost and higher total cost to administer. Some contracts attempt to transfer risks from the owner to the contractor. Others reward contractors for charging an owner a higher number of hours, and some reward contractors for superior performance and the value they bring to an owner.

Alternative strategies

An effective performance contract uses financial incentives that motivate contractors to help achieve your business goals and objectives. Often, the incentives flow through the contractor organization to reward its employees as well as subcontractors. Unlike traditional contracts for services, every contractor employee should know and understand what actions result in increased benefit for the owner and employee.

Performance-based partnering contracts maximize the benefits of outsourcing while eliminating or minimizing the need to self-perform. Leveraging contractor expertise has many benefits. Owners can access highly skilled and scarce resources and use a pay-as-you-go strategy, which converts fixed costs to variable costs. Performance contracts also can reduce business risk while reducing the total cost of ownership and increasing plant productivity. Using contractors instead of hiring employees to self-perform also alleviates accrued legacy costs that often burden future earnings, such as pension and medical costs for retired personnel. Properly structured performance contracts also reduce the cost of contracting and contract administration compared to more conventional contracting approaches.

Performance metrics

Performance contracts are either strategic or non-strategic; the difference being in the effect the scope of work can have on business results. For example, a poorly maintained restroom won’t have much impact on plant productivity or profitability and is, therefore, non-strategic.

However, a poorly maintained manufacturing process can reduce product quality and throughput substantially while increasing product and environmental liability, risks and cost. Any scope of work that directly affects plant productivity or profitability is considered to be strategic.

Performance contracts for non-strategic services usually allow the contractor to have full control of project performance and scope of work, and use simple metrics (cost reduction, productivity and customer satisfaction). Standard procurement practices or reverse auction works well for procuring a non-strategic, task-oriented, commodity-based scope of work.

The metrics that drive performance fees serve as the compass and map for a strategic, performance-based partnering contract. These metrics drive the behavior of the service providers and ultimately the success of the partnership. While it’s critical that the service provider have some control or significant influence on the metrics, it’s also important that the metrics have a direct and meaningful bearing on the plant owner’s financial performance. Similarly, it’s critical that the metrics are balanced to avoid suboptimization or silos of performance that harm your plant’s overall financial picture. The goal is to establish performance-based fee metrics that ensure the service provider’s decisions and actions are in concert with the owner’s needs.

Jim Humphries, P.E., is vice president of performance technology at Fluor Corp., Greenville, S.C. Contact him at [email protected] and (864) 281-4400.

Figures courtesy of Fluor Corp.